In South Africa, Ponzi Schemes pose a significant financial risk due to their exploitation of economic disparities and cultural ties. To combat this, investors must be vigilant, recognizing red flags like unrealistic returns and pressure tactics. Education, professional advice, and regulatory measures like strict licensing are crucial tools for protection. By staying informed, diversifying investments, and avoiding high-pressure sales, individuals can safeguard themselves from these deceptive schemes.

“Unveiling the insidious nature of Ponzi Schemes in South Africa is crucial for investors to safeguard their financial futures. This article provides a comprehensive guide to understanding these fraudulent investment schemes within the local context, highlighting common warning signs to look out for. We explore effective strategies for investors to protect themselves and delve into the regulatory landscape governing Ponzi Schemes in the country. By recognizing potential red flags, individuals can avoid becoming victims and make informed investment decisions.”

- Understanding Ponzi Schemes: A South African Perspective

- Common Warning Signs of a Ponzi Scheme

- Protecting Yourself: Strategies for Investors

- The Impact and Regulation of Ponzi Schemes in South Africa

Understanding Ponzi Schemes: A South African Perspective

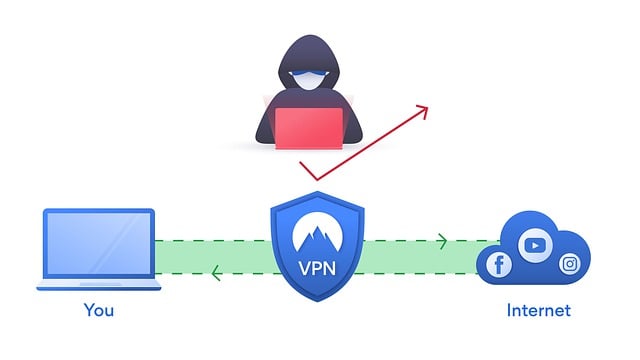

In the realm of Ponzi Schemes in South Africa, understanding the insidious nature of these fraudulent investment schemes is paramount for both investors and regulatory bodies. A Ponzi scheme, at its core, promises high returns with little or no risk, attracting investors with the allure of quick profits. However, beneath this deceptive facade lies a structure where early investors are paid off with funds contributed by later investors, creating a fragile financial pyramid that can collapse rapidly. In South Africa, where economic disparities and investment opportunities are vast, these schemes have shown a troubling resilience.

The unique challenges posed by Ponzi Schemes in South Africa stem from the country’s diverse cultural and linguistic landscapes, as well as its dynamic financial sector. Con artists often exploit trust and cultural ties to lure investors, making it crucial for individuals to be vigilant and educated about potential red flags. Common warning signs include unrealistic investment promises, pressure to act quickly, lack of transparency, and inconsistent or unrealistic returns. Staying informed and seeking professional advice are essential steps in protecting oneself from these sophisticated frauds that have no place in South Africa’s economic tapestry.

Common Warning Signs of a Ponzi Scheme

In the world of Ponzi Schemes In South Africa, it’s crucial to be able to identify warning signs that could protect investors from significant financial losses. These schemes often attract attention with promises of high returns with little or no risk, but they’re built on a foundation of deceit. Common indicators include excessive and consistent promises of high returns, lack of transparency in how investments are made, and pressure to invest quickly without allowing time for proper due diligence.

Additional red flags include the use of new money to pay existing investors, elaborate lies or unrealistic stories about investment strategies, and a refusal to share financial records or provide contact information for regulatory bodies. Given the intricate nature of these schemes, it’s essential for potential investors in Ponzi Schemes In South Africa to conduct thorough research and seek advice from trusted sources before committing their funds.

Protecting Yourself: Strategies for Investors

When it comes to protecting yourself from Ponzi Schemes in South Africa, being vigilant and informed is key. As an investor, it’s crucial to understand that these schemes often prey on desperation and promise unrealistic returns. Look out for high-pressure sales tactics, unusually consistent or high returns with little risk, and the promotion of a new or untested investment strategy.

Diversify your portfolio across various asset classes, always verify the legitimacy of investment opportunities, and be wary of investments that lack transparency. Regularly review your investments, keeping an eye on market trends and staying informed about any red flags related to Ponzi Schemes in South Africa. Remember, if it sounds too good to be true, it probably is.

The Impact and Regulation of Ponzi Schemes in South Africa

In South Africa, Ponzi schemes have become a growing concern, impacting investors and the economy at large. These fraudulent investment operations promise high returns with minimal risk, attracting unsuspecting individuals looking for financial gains. Once established, Ponzi schemes operate by using new investor funds to pay off older ones, creating a false sense of profitability. As such, they often leave a trail of ruined lives and businesses in their wake.

The South African government has implemented regulatory measures to combat these schemes, including stringent licensing requirements for financial advisors and investment managers. Financial intelligence units also play a crucial role in monitoring suspicious activities and reporting them to relevant authorities. However, as Ponzi schemes evolve to exploit new vulnerabilities, continued vigilance is necessary. Investors are encouraged to be aware of warning signs, such as unrealistic promises of high returns, lack of transparency, and pressure to act quickly, which could indicate a potential Ponzi scheme.

In navigating the complex financial landscape of South Africa, understanding the insidious nature of Ponzi schemes is paramount. By recognizing common warning signs and adopting robust protective strategies, investors can safeguard their hard-earned money. The impact and regulation of these schemes within the country underscore the need for vigilance and informed decision-making. Staying alert and proactive is crucial in the fight against Ponzi Schemes in South Africa, ensuring investors’ protection and promoting a more transparent financial environment.