Offshore tax planning helps high-net-worth individuals legally optimize taxes, protect wealth, and access global investment opportunities while adhering to global regulations. By structuring assets through special purpose entities (SPEs) in favorable tax jurisdictions, they can significantly reduce liabilities, enhance asset protection, and strategically grow their wealth for the long term, thus Building A Secure Financial Future With Offshore Tax Planning. This requires professional expertise in navigating complex international tax laws ethically and transparently.

“Uncover the secrets of building a secure financial future with offshore tax planning—a comprehensive guide tailored for high-net-worth individuals. This article demystifies complex strategies, offering insights into the basics and benefits of offshore tax planning. We’ll explore effective tactics to optimize your global assets and navigate legal, ethical considerations. By understanding these principles, you can make informed decisions, ensuring compliance while maximizing savings towards your financial aspirations.”

- Understanding Offshore Tax Planning: The Basics and Benefits

- Strategies for Effective Offshore Tax Planning

- Navigating the Legal and Ethical Considerations in Offshore Tax Planning

Understanding Offshore Tax Planning: The Basics and Benefits

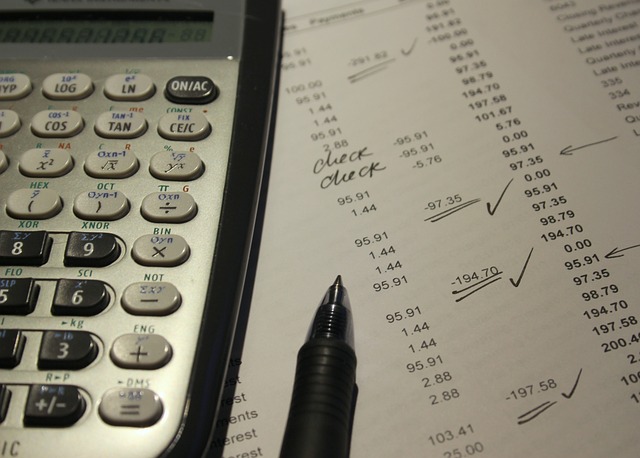

Offshore tax planning is a strategic approach that enables high-net-worth individuals to optimize their tax liabilities and build a more secure financial future. It involves utilizing legal avenues to structure assets and investments in jurisdictions with favorable tax treatments, allowing for significant savings while adhering to global tax regulations. The concept isn’t about evading taxes but rather legally minimizing them through strategic planning.

The benefits are multifaceted: it can help protect wealth, provide access to more investment opportunities, and offer greater control over one’s financial assets. By understanding the nuances of offshore tax planning, individuals can make informed decisions to simplify their tax affairs, reduce exposure to high rates, and strategically grow their wealth for the long term.

Strategies for Effective Offshore Tax Planning

Building a secure financial future often involves strategic tax planning, and for high-net-worth individuals, exploring offshore options can be a game-changer. Effective offshore tax planning isn’t just about minimizing liability; it’s a nuanced approach to structuring your assets and investments to create long-term financial security. One key strategy is utilizing special purpose entities (SPEs), which allow for better asset protection and wealth transfer. SPEs are legal structures that can hold specific assets or conduct particular business activities, providing flexibility in managing taxes and reducing the overall tax burden.

Additionally, taking advantage of favorable tax jurisdictions is essential. Different countries offer unique incentives, such as low or no corporate taxes, which can significantly impact your overall tax strategy. By carefully selecting these jurisdictions, you can legally reduce your tax exposure while ensuring compliance with international regulations. This strategic planning should be tailored to each individual’s unique financial situation, with the help of experts who understand the intricate world of offshore taxation.

Navigating the Legal and Ethical Considerations in Offshore Tax Planning

Navigating the legal and ethical considerations in offshore tax planning is paramount for high-net-worth individuals aiming to build a secure financial future. While offshore structures can offer significant advantages, such as asset protection and wealth preservation, they must be implemented with care to avoid legal and regulatory pitfalls. Engaging experienced professionals who are well-versed in international tax laws is essential to ensure compliance and mitigate risks.

Ethical practices are equally vital. High-net-worth individuals must act responsibly, avoiding schemes that could be deemed abusive or manipulative. Transparent reporting, accurate record-keeping, and adherence to local and global tax standards are key components of ethical offshore tax planning. By combining legal acumen with ethical principles, individuals can leverage offshore structures effectively while maintaining integrity and upholding their financial obligations.

Building a secure financial future often involves strategic tax planning, especially for high-net-worth individuals. This guide has provided an in-depth look at offshore tax planning, highlighting its benefits and offering practical strategies to optimize your finances. While it’s crucial to navigate legal and ethical considerations, a well-informed approach can help you make the most of available opportunities. By implementing these insights, you can take control of your financial future, ensuring compliance and maximizing savings.