Ponzi schemes, a global financial threat, have targeted South Africans, especially during economic downturns, exploiting the vulnerable with high-return promises. To counter this, regulatory bodies like the FSCA and FSB have implemented stringent licensing, anti-money laundering, and know-your-customer protocols, while encouraging financial literacy to identify red flags. By staying vigilant, diversifying investments, and reporting suspicious activities, South Africans can protect themselves from these insidious scams, ensuring a secure financial landscape.

In recent years, the prevalence of Ponzi schemes in South Africa has grown, posing significant risks to investors. This article delves into the intricacies of these fraudulent investment plans, exploring their rising occurrence within the country’s economic landscape. By understanding the subtle nuances of Ponzi schemes, we can identify red flags and protect our financial interests. We examine current regulatory measures, the role of institutions and investors, and provide essential strategies to safeguard investments from these deceptive practices, specifically targeted at Ponzi Schemes In South Africa.

- Understanding Ponzi Schemes: A Brief Overview

- The Prevalence of Ponzi Schemes in South Africa

- Identifying Red Flags: Signals to Watch Out For

- Regulatory Framework and Current Measures to Combat Fraud

- The Role of Financial Institutions and Investors

- Preventive Strategies: Safeguarding Your Investments

Understanding Ponzi Schemes: A Brief Overview

Ponzi schemes are a type of fraudulent investment operation that has plagued financial markets globally, including South Africa. At their core, Ponzi schemes promise high returns with minimal risk to investors. The operator typically attracts initial investors by offering substantial profits, generated not from actual business activities or investments, but from the capital contributed by subsequent investors. This unsustainable model relies on a constant influx of new money to pay off early investors, creating a pyramid-like structure.

In South Africa, where financial literacy and regulatory frameworks play a crucial role in protecting investors, staying vigilant against Ponzi schemes is essential. The country’s regulatory bodies, such as the Financial Sector Conduct Authority (FSCA), have implemented measures to detect and prevent these schemes, including strict licensing requirements for financial service providers. By educating investors about the red flags associated with Ponzi schemes and fostering a culture of financial literacy, South Africa can better protect its citizens from falling victim to these deceptive practices.

The Prevalence of Ponzi Schemes in South Africa

In recent years, Ponzi Schemes in South Africa have emerged as a significant concern for investors and financial regulators alike. These fraudulent investment schemes, which promise high returns with little to no risk, have found fertile ground in the country’s economic landscape. The allure of quick wealth has enticed many South Africans, particularly during periods of economic uncertainty, leading to a growing number of reported cases. What makes these schemes even more insidious is their ability to operate under the radar for extended periods, luring victims with false promises of substantial returns.

The prevalence of Ponzi Schemes in South Africa highlights the need for heightened vigilance and improved awareness among investors. Many of these schemes exploit the financial vulnerabilities of individuals, often targeting the elderly, low-income earners, and those seeking alternative investment opportunities. With sophisticated marketing strategies and a network of trusted associates, con artists orchestrate these scams, making it crucial for regulators to stay proactive in their detection and prevention efforts.

Identifying Red Flags: Signals to Watch Out For

In the complex landscape of financial investments, spotting the subtle nuances of a Ponzi scheme within the bustling financial sector of South Africa is paramount for both investors and regulatory bodies alike. These schemes, masterfully disguised as legitimate investment opportunities, often attract unsuspecting individuals with promises of unparalleled returns. However, closer inspection reveals a pattern of fraudulent activities where recent investor funds are used to pay older participants, creating a false sense of profitability. To stay ahead in this game, it’s crucial to be vigilant and identify red flags that may signal the presence of a Ponzi scheme.

Key indicators include consistent high returns with little or no risk, an overwhelming focus on bringing in new investors to sustain the “growth,” and a lack of transparency in how funds are actually being utilized. Additionally, when investment opportunities promise returns that far exceed market averages, it’s essential to tread carefully. The South African financial regulatory bodies play a crucial role in monitoring these schemes by encouraging investors to report any suspicious activities and by implementing stringent measures to detect and disrupt Ponzi operations before they cause significant harm to the economy and individual investors.

Regulatory Framework and Current Measures to Combat Fraud

South Africa’s financial landscape, like many others globally, has witnessed the insidious rise of Ponzi schemes, posing significant challenges to investors and regulatory bodies alike. The fight against these fraudulent investment scams necessitates a robust Regulatory Framework that can adapt to evolving tactics employed by perpetrators. Fortunately, the country has implemented measures to combat such fraud, with the Financial Services Board (FSB) playing a pivotal role in monitoring and regulating financial markets.

The FSB, an independent regulatory authority, is tasked with ensuring stability and fairness in South Africa’s financial sector. They have put in place stringent rules and guidelines for investment schemes, including strict disclosure requirements and anti-money laundering protocols. These measures aim to protect investors by promoting transparency and accountability among financial institutions. By staying vigilant and leveraging technology, the FSB can effectively identify and shut down potential Ponzi schemes, safeguarding the interests of innocent investors in South Africa.

The Role of Financial Institutions and Investors

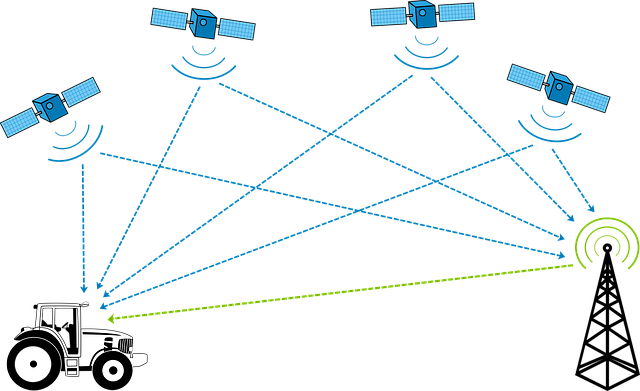

In the fight against Ponzi schemes in South Africa, financial institutions and investors play a pivotal role. Financial institutions, such as banks and investment firms, are on the front lines when it comes to detecting these fraudulent operations. They have the expertise and resources to analyze patterns and identify suspicious activities that may indicate a Ponzi scheme. By implementing robust anti-money laundering (AML) and know-your-customer (KYC) procedures, they can help prevent the flow of funds into such schemes.

Investors, on their part, must remain vigilant and informed. Many Ponzi schemes lure investors with promises of high returns with little or no risk. Educating oneself about these scams and understanding the fundamentals of investments is crucial. Investors should always conduct thorough research before committing their money, seek professional advice when needed, and be wary of excessive claims or unrealistic promises. Together, financial institutions and investors can significantly contribute to curbing the prevalence of Ponzi schemes in South Africa.

Preventive Strategies: Safeguarding Your Investments

In the fight against Ponzi schemes in South Africa, a proactive approach to prevention is crucial. Individuals and investors must become vigilant and educated to safeguard their financial future. One effective strategy is diversifying investments; spreading your capital across various assets reduces risk. Additionally, staying informed about market trends and keeping an eye on investment returns are essential steps. Regularly reviewing investment portfolios can help identify any suspicious activities or patterns associated with Ponzi schemes.

Educational initiatives play a vital role in raising awareness among the public. Understanding basic investment principles and common scam tactics empowers people to make informed decisions. Financial institutions and regulatory bodies should collaborate to provide accessible resources and workshops, ensuring that South Africans are equipped to recognize and avoid potential Ponzi schemes, thereby fostering a more secure investment environment.

In light of the persistent threat posed by Ponzi schemes in South Africa, it’s clear that vigilance is paramount. By understanding the intricacies of these fraudulent structures, recognizing red flags, and implementing robust regulatory frameworks, the country can significantly reduce their occurrence. Financial institutions and investors both play crucial roles in this battle; their proactive participation is essential to protecting the economy and individual savers. Adopting preventive strategies and staying informed are key measures that can safeguard investments and deter potential fraudsters, ultimately fostering a more secure financial environment in South Africa.