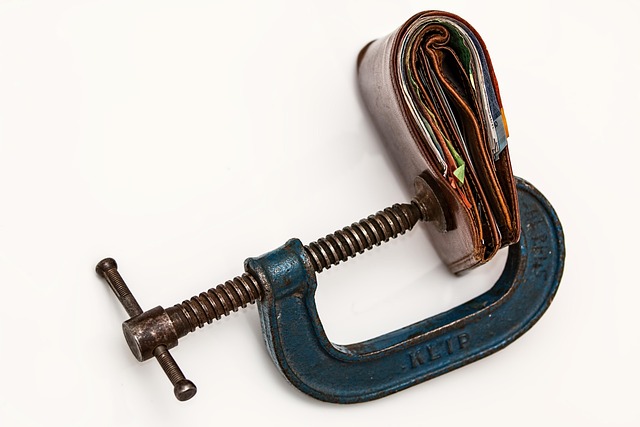

Debt consolidation loans streamline multiple high-interest debts into a single loan with lower rates and manageable payments, freeing up cash flow, saving money, and improving credit scores. To secure the best Loan For Debt Consolidation, thoroughly research different types of Debt Consolidation Loans, compare lenders based on interest rates, fees, and prepayment penalties, and ensure the loan aligns with your goal to reduce monthly payments effectively. Good creditworthiness increases access to favorable interest rates.

Looking to simplify your finances and reduce monthly payments? A Loan for Debt Consolidation could be the solution. This comprehensive guide explores Debt Consolidation Loans, breaking down their intricacies and benefits. We’ll help you navigate the process by detailing effective strategies to choose the right loan and lower your payments. Whether you’re overwhelmed by multiple debts, this article provides valuable insights to transform your financial outlook.

- Understanding Debt Consolidation Loans: A Comprehensive Guide

- How to Choose the Right Loan for Your Debt Consolidation Needs

- Strategies for Lowering Monthly Payments with a Single Debt Consolidation Loan

Understanding Debt Consolidation Loans: A Comprehensive Guide

Debt consolidation loans offer a strategic approach to managing multiple debts by combining them into a single loan with potentially lower interest rates and more manageable payments. This process simplifies financial obligations, making it easier for borrowers to stay on top of their repayments. A loan for debt consolidation allows individuals to pay off various creditors in full, erasing the burden of separate minimum payments that often vary in amount and due dates.

By consolidating debts, borrowers can expect to reduce their monthly outgoings and potentially free up extra cash flow. This method is particularly beneficial for those burdened by high-interest rates on multiple credit lines. It provides a clear repayment plan, making financial goals more attainable. Effective debt consolidation not only simplifies life but also paves the way for improved credit scores over time with consistent on-time payments.

How to Choose the Right Loan for Your Debt Consolidation Needs

When considering a loan for debt consolidation, it’s crucial to do your research and understand various loan types available in the market. Different loans offer unique features, interest rates, and repayment terms that can significantly impact your overall savings and financial health. The key is to find a loan tailored to your specific needs and circumstances.

Start by assessing your current debt: calculate the total amount you owe across all creditors and determine your desired repayment period. Next, explore options such as personal loans for debt consolidation, which often offer competitive rates and fixed monthly payments. Compare lenders and their terms, focusing on interest rates, fees, and any prepayment penalties. A Loan for Debt Consolidation should simplify your financial obligations, so choose a lender that aligns with your goal of reducing monthly payments and managing debt effectively.

Strategies for Lowering Monthly Payments with a Single Debt Consolidation Loan

When considering a Debt Consolidation Loan, one of the primary goals is to lower your monthly payments. This strategy involves combining multiple high-interest debts into a single, lower-interest loan with a longer repayment term. By doing so, you can significantly reduce the amount you pay each month and free up cash flow for other expenses.

There are several approaches to achieve this: extending the loan term to lower monthly payments, negotiating a lower interest rate, or using the consolidation loan to pay off high-interest debts first, which can save money in the long run. Additionally, ensuring good creditworthiness before applying for a loan for debt consolidation is crucial as it increases your chances of securing a better interest rate, thereby further reducing monthly payments.

Debt consolidation loans offer a strategic approach to managing multiple debts by combining them into a single, more manageable loan. By choosing the right loan for your needs and implementing effective strategies, such as lowering monthly payments, you can gain control over your finances and work towards debt freedom faster. A Loan for Debt Consolidation can simplify your financial life and provide a clearer path toward achieving your monetary goals.