This text emphasizes critical errors people make in inheritance planning, such as outdated beneficiary designations, lack of legal documents like wills or trusts, ignored tax consequences, and overlooked assets. It offers solutions like regular reviews, professional guidance, staying informed about legal updates, and open communication with family to avoid these common mistakes, ensuring efficient asset distribution according to one's wishes.

“Unaware of potential pitfalls, many individuals overlook critical aspects of inheritance planning, leading to costly estate mistakes. This comprehensive guide aims to illuminate ten common blunders and equip readers with actionable strategies to avoid them. From outdated wills to a lack of beneficiary updates, we explore the consequences and offer solutions for each issue. By understanding these common estate planning mistakes, you can ensure your wishes are accurately executed, minimizing legal complexities and preserving peace of mind.”

- Understanding Inheritance Planning Mistakes: Common Pitfalls

- Misunderstanding the Impact of Outdated Wills

- Neglecting to Update Beneficiaries: Consequences and Prevention

- Overlooking Tax Implications: Costly Omissions

- Lack of Communication: A Recipe for Family Conflict

Understanding Inheritance Planning Mistakes: Common Pitfalls

Many people overlook inheritance planning as a vital part of their estate planning process. This can lead to significant mistakes, often with costly consequences. Understanding common inheritance planning pitfalls is essential when safeguarding your assets and ensuring your wishes are respected after your passing. By recognizing these errors, you can proactively navigate the complexities of estate planning.

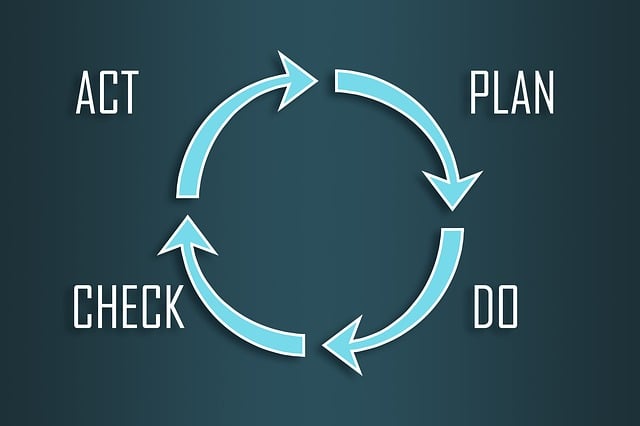

Some of the most frequent mistakes include failing to update beneficiary designations, neglecting to create a will or trust, not considering potential tax implications, and overlooking the impact of existing legal documents. Additionally, inadequate communication with loved ones about your plans and omitting important assets from your inheritance can cause confusion and dissatisfaction among beneficiaries. How You Can Avoid the Most Common Estate Planning Mistakes involves regular reviews, seeking professional advice, staying informed about legal changes, and maintaining open dialogue with your family.

Misunderstanding the Impact of Outdated Wills

Outdated wills can lead to significant inheritance planning mistakes, often with unforeseen consequences for your beneficiaries. As life goes on, our circumstances change—marriage, divorce, birth of children, and career shifts are just a few examples—and so should our estate plans. A will that hasn’t been updated in years may not accurately reflect your current wishes or even acknowledge new family members. This can result in disputes among heirs and potentially inefficient asset distribution.

To avoid these issues, it’s crucial to review and update your will regularly. Consider consulting an attorney every few years or whenever significant life events occur. This proactive approach ensures your estate planning remains robust and effective, enabling you to have peace of mind knowing your wishes will be respected while minimizing potential inheritance planning mistakes.

Neglecting to Update Beneficiaries: Consequences and Prevention

Neglecting to update beneficiaries is one of the most costly inheritance planning mistakes one can make. When you fail to review and revise your beneficiary designations, especially after significant life events like marriage, divorce, or the birth of a child, it can lead to unintended consequences. For instance, if you own multiple accounts with different beneficiary names, an oversight in updating one could mean that while some heirs receive their share, others are left out entirely. This mistake not only causes legal and financial chaos but also prevents your estate from being distributed according to your wishes.

Prevention is key when it comes to this error. Regularly reviewing and updating your beneficiary designations across all accounts – bank statements, retirement plans, insurance policies, and investment portfolios – ensures that your inheritance planning remains current. Consider setting reminders on your calendar or engaging a financial advisor to help you keep track of these changes. This proactive approach will safeguard your estate from potential disputes and ensure that your loved ones receive the inheritances you intended for them.

Overlooking Tax Implications: Costly Omissions

Many individuals make the mistake of overlooking tax implications within their inheritance planning. This can lead to significant financial burdens for their beneficiaries, potentially undermining the very purpose of estate planning. Tax laws vary widely and can change over time, so it’s crucial to stay informed and consult professionals who understand these intricacies. Failing to consider capital gains, estate taxes, and inheritance tax regulations can result in unexpected costs that deplete assets intended for heirs.

To avoid these costly omissions, how you structure your estate is essential. Proper planning can help minimize tax liabilities and ensure your wishes are fulfilled. By taking the time to understand tax implications, you can make informed decisions, ensuring a smooth transfer of wealth while maintaining the integrity of your inheritance plan.

Lack of Communication: A Recipe for Family Conflict

In many families, discussions about inheritance and estate planning are often considered taboo or uncomfortable. This lack of communication can lead to significant conflicts down the line. When family members aren’t involved in the early stages of planning, they may feel left out or misunderstood when decisions are finally made. More importantly, it can result in disputes over assets, especially if there are differing opinions on how the estate should be distributed after a loved one passes away.

Avoiding these inheritance planning mistakes starts with open dialogue. As a family, consider bringing together a professional to facilitate discussions about your wishes and expectations regarding assets and property. Regular conversations not only help in aligning goals but also ensure everyone is on the same page. This proactive approach can prevent misunderstandings and foster harmony among family members when it comes to estate matters.

Estate planning is a crucial aspect of securing your legacy, but it’s easy to fall into common pitfalls. By understanding and avoiding these 10 costly inheritance planning mistakes, you can ensure your wishes are accurately reflected while minimizing potential family conflicts and tax implications. Remember, staying informed and keeping your estate plans up-to-date is the key to a smooth transition for your loved ones. Implement these strategies today to safeguard your future and leave a lasting legacy without unnecessary hurdles.