High-interest debts can create financial strain, but Debt Consolidation Loans offer a strategic escape route. By combining multiple high-rate debts into one single repayment with lower rates, these loans provide immediate stress relief and long-term financial benefits. Researching various loan types is key to finding the best fit based on individual needs, while understanding the application process ensures access to a Loan For Debt Consolidation that could substantially reduce debt burdens.

Struggling with high-interest debt? There’s hope in the form of Debt Consolidation Loans. This comprehensive guide explores how these low-rate loan solutions can simplify your financial burden. We delve into the impact of high-rate debt and provide a step-by-step roadmap to securing a loan for debt consolidation. Learn how this strategic approach can help you gain control, reduce monthly payments, and ultimately free yourself from debt.

- Understanding High-Rate Debt and Its Impact

- Exploring Low-Rate Loan Solutions for Debt Consolidation

- Navigating the Process: Steps to Secure a Loan for Debt Consolidation

Understanding High-Rate Debt and Its Impact

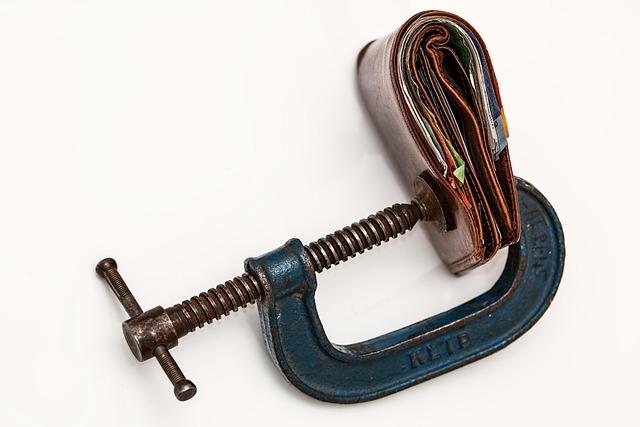

High-rate debt can significantly impact an individual’s financial health, creating a cycle of stress and increased financial burden. This often occurs when multiple high-interest loans or credit cards are used to cover daily expenses, leading to a situation where interest payments alone can consume a substantial portion of disposable income. The weight of these obligations can hinder savings, make it difficult to meet unexpected costs, and even affect one’s ability to secure future loans due to poor credit scores.

Debt consolidation loans emerge as a strategic solution, offering lower interest rates that can alleviate the strain of high-rate debt. A loan for debt consolidation allows individuals to consolidate multiple debts into a single repayment, simplifying financial obligations and potentially reducing overall interest charges. This not only provides relief from the immediate pressure but also paves the way for improved creditworthiness in the long term.

Exploring Low-Rate Loan Solutions for Debt Consolidation

For many individuals burdened by high-interest debt, exploring low-rate loan solutions for debt consolidation can be a game-changer. This strategy involves taking out a new loan with a lower interest rate to pay off existing debts, simplifying repayment and potentially saving significant money in interest expenses. Debt consolidation loans offer the advantage of combining multiple debts into one, making it easier to manage payments and potentially improving credit scores over time.

When considering a loan for debt consolidation, individuals should research various options, including personal loans from banks or credit unions, home equity loans, or even balance transfer credit cards. Each option has its own set of pros and cons, with interest rates varying based on factors like creditworthiness, the amount borrowed, and the length of the loan term. Careful comparison and selection of the most suitable debt consolidation loan can lead to better financial health and long-term savings.

Navigating the Process: Steps to Secure a Loan for Debt Consolidation

Navigating the process of securing a loan for debt consolidation involves several key steps. Firstly, assess your financial situation and calculate the total amount you owe across all debts. This will help determine the type and size of Loan For Debt Consolidation suitable for your needs. Next, compare different lenders and their offerings to find the best interest rates and terms. Consider factors like repayment periods, fees, and any associated costs to ensure a loan aligns with your budget.

Once you’ve identified a preferred lender, prepare necessary documents such as proof of income, identity, and assets. These documents are essential for verifying your eligibility and facilitating the loan approval process. Finally, submit an application, be transparent about your financial history, and patiently await the lender’s decision. A successful application can lead to substantial savings through consolidated debt repayment with a lower interest rate.

High-rate debt can be a burden, but exploring low-rate loan solutions like debt consolidation loans offers a promising path forward. By taking strategic steps to secure a loan for debt consolidation, individuals can gain control of their financial situations and pave the way for a more stable future. This approach allows for better management, reduced stress, and the opportunity to rebuild credit healthily.