Debt consolidation in South Africa is a strategic solution for managing multiple loans by combining them into one with lower interest rates, simplifying repayment terms. This approach helps borrowers save on interest expenses, free up extra cash each month, and gain financial control over high-interest debt obligations like credit cards and personal loans. While longer repayment terms may result in higher overall interest paid, consolidation provides clarity, reduces stress, and is beneficially paired with financial counseling or education.

In the face of mounting debt, South Africans are increasingly turning to debt consolidation as a solution. This article explores the role of debt consolidation companies in providing much-needed relief to borrowers. We’ll delve into what debt consolidation is, its numerous benefits tailored to South African consumers, and how to navigate the landscape to choose a reputable company. Understanding these aspects is crucial for making informed decisions regarding your financial future.

- Understanding Debt Consolidation and its Benefits in South Africa

- – Definition of debt consolidation

Understanding Debt Consolidation and its Benefits in South Africa

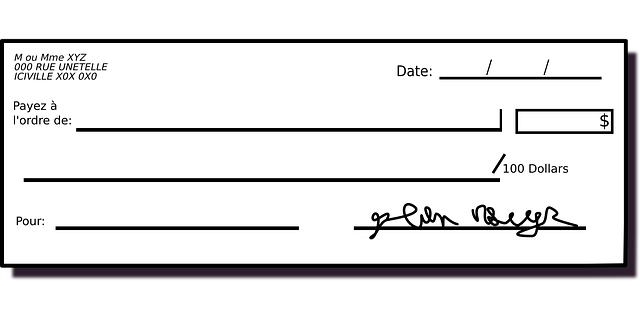

Debt consolidation is a financial strategy where an individual combines multiple debts into one single loan with a lower interest rate and more manageable terms. This approach allows for better organisation of payments, simplifying the process for borrowers in South Africa who often deal with various lenders and varying repayment conditions. By consolidating their debt, South Africans can save on interest expenses and potentially free up extra cash each month.

In the context of South Africa, where high levels of consumer debt are prevalent, consolidation offers several benefits. It provides borrowers with a clear repayment plan, reducing the stress and anxiety often associated with multiple debt obligations. Moreover, it enables individuals to focus on paying off their debt more efficiently, which can be particularly advantageous in a country with a unique economic landscape and diverse lending practices.

– Definition of debt consolidation

Debt consolidation is a financial strategy where an individual or business combines multiple debts into one single loan with a lower interest rate. This process simplifies repayment by reducing the number of payments needed, making it easier to manage and potentially saving money on interest expenses. In South Africa, with its diverse economic landscape and varied debt scenarios, the consolidation of debt has become a significant tool for many. It allows borrowers to take control of their finances by streamlining high-interest debts, such as credit card balances or personal loans, into one manageable repayment plan.

For South Africans grappling with multiple debt obligations, consolidating can offer relief and improved financial stability. These consolidated loans often have longer repayment terms, which means lower monthly payments but potentially higher interest over the life of the loan. However, it’s a strategic approach to gaining clarity and consistency in managing personal finances, especially when coupled with financial counselling or education.

In conclusion, the consolidation of debt in South Africa offers individuals a strategic path to financial stability. By partnering with reputable debt consolidation companies, South Africans can navigate their debt burden more effectively. This article has highlighted the benefits of consolidation, including lower interest rates, simplified repayment schedules, and improved credit scores. However, it’s crucial to exercise caution, research extensively, and compare different offers before committing, ensuring you choose a trustworthy provider that aligns with your financial goals.