Retiring early (RE) in just 5 years and achieving financial independence (FI) is a feasible goal for those who adopt aggressive saving, strategic investing, and minimalist living. This involves living below means, leveraging passive income from investments, and exploring remote work to gain location independence. By setting a clear target of FI within 5 years, individuals can streamline finances, embrace frugal habits, and make significant lifestyle changes, ultimately achieving freedom from traditional employment cycles.

Can you achieve financial independence and retire early in just 5 years? This ambitious goal is gaining traction among those seeking freedom from traditional career paths. Understanding what financial independence (FI) means and why retiring early appeals to many is the first step. By aggressively saving, investing, paying off debt, living below means, and exploring side hustles, it’s possible to accelerate your path to FI. However, market volatility, time constraints, psychological challenges, and adjusting lifestyle expectations are key factors that require careful consideration on this journey towards an early retirement.

- Understanding Financial Independence and Early Retirement

- – Define financial independence and early retirement

- – Discuss the appeal and benefits of achieving FI in 5 years

Understanding Financial Independence and Early Retirement

Financial independence is a goal many aspire to, and retiring early, or reaching financial independence (FI) in a shorter time frame, has gained significant traction in recent years. This concept goes beyond simply having a substantial savings account; it’s about achieving a lifestyle where your passive income sources cover your expenses, allowing you to live without the need for traditional employment.

Reaching FI in 5 years is an ambitious yet attainable goal for many, especially when combined with strategies like aggressive saving, intelligent investing, and minimalism. The term ‘Retire Early’ (RE) enthusiasts often emphasize living below your means and making thoughtful financial decisions to accelerate this process. It requires dedication, discipline, and a well-planned strategy to navigate the financial landscape and secure a future free from the constraints of a 9-to-5 job.

– Define financial independence and early retirement

Financial independence, often tied to the concept of retiring early (RE), refers to a state where your passive income from investments and savings is sufficient to cover your living expenses without relying on active employment. This goal involves achieving financial freedom, allowing you to choose when and how you spend your time, rather than being constrained by a 9-to-5 job. Early retirement takes this concept further, aiming for an exit from the workforce before traditional retirement age, often enabling a life unburdened by work constraints.

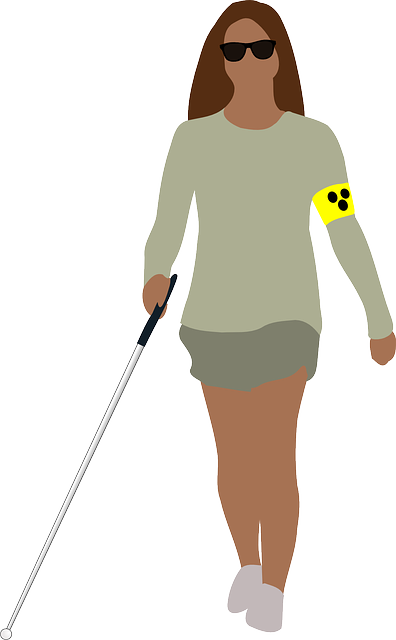

Reaching these milestones requires discipline, strategic planning, and significant savings. It involves managing expenses, investing wisely, and potentially adopting alternative lifestyles to cut costs. Many who pursue early retirement opt for minimalist or digital nomad approaches, leveraging technology to work remotely and gain location independence while generating passive income from investments.

– Discuss the appeal and benefits of achieving FI in 5 years

Achieving financial independence (FI) in just 5 years is an appealing prospect for many, especially those eager to retire early and seize control of their time. The benefits are numerous; it allows individuals to break free from the traditional 40-year work cycle, offering the chance to pursue passions, travel, or spend more quality time with family. This ambitious goal can be a powerful motivator, encouraging people to reassess their spending habits, maximize savings, and explore alternative income streams.

By setting a clear target of FI within 5 years, individuals can develop tailored strategies to streamline their finances. This may involve significant lifestyle changes, such as minimizing discretionary spending, negotiating better terms with service providers, or embracing more frugal habits. With dedication and discipline, many have successfully demonstrated that reaching financial independence in a relatively short period is not just a dream but a realistic goal, paving the way for a life of freedom and choice.

Reaching financial independence (FI) in just 5 years is an ambitious yet achievable goal for many. By understanding what FI entails, setting clear targets, and implementing strategic savings and investment plans, it’s possible to drastically reduce your reliance on traditional employment. While the path to early retirement (ER) may be challenging, the benefits—including increased freedom, flexibility, and time for passions—can make it a worthwhile pursuit. Remember, each individual’s circumstances are unique, so tailoring a plan that aligns with your goals and risk tolerance is key.