In South Africa, debt restructuring for individuals offers a vital pathway to regain control over finances. By negotiating with creditors, strategies like debt consolidation or direct term adjustments create manageable repayment plans. This process, guided by understanding the National Credit Act, addresses diverse debt challenges from credit cards to mortgages. A thorough financial assessment and transparent communication ensure personalized agreements lead to debt-free futures, offering stability, peace of mind, and financial independence.

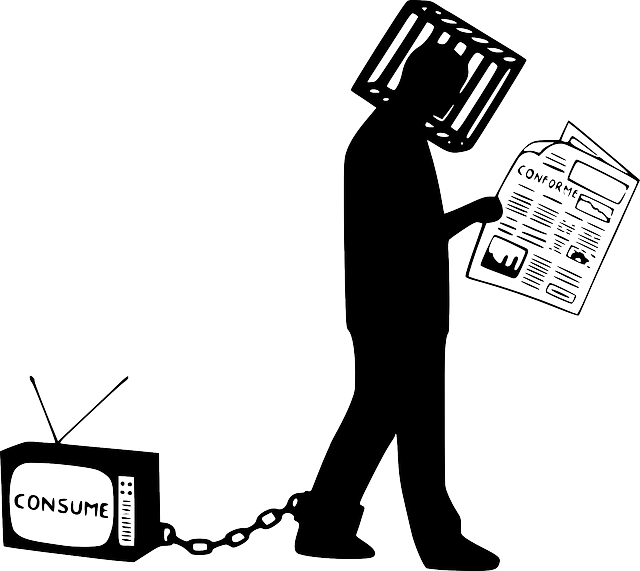

Breaking free from debt is a powerful step towards financial freedom. In South Africa, debt restructuring for individuals offers a lifeline for those overwhelmed by debt. This comprehensive guide explores how to navigate this process in our unique context. From understanding the basics of individual debt restructuring to deciphering various debt types and their associated options, we’ll walk you through the steps, benefits, and potential challenges. Take control of your financial future today.

- Understanding Individual Debt Restructuring in South Africa

- Common Types of Debt and Their Restructuring Options

- The Process: Steps to Effective Debt Restructuring

- Benefits and Challenges: Breaking Free from Debt

Understanding Individual Debt Restructuring in South Africa

In South Africa, individual debt restructuring is a crucial process that helps people gain control over their financial situations. It involves working with creditors to adjust loan terms and create a more manageable repayment plan. This option is particularly beneficial for those struggling with overwhelming debts, offering a chance to break free from the cycle of repayments and regain financial stability.

Debt restructuring can take various forms, including debt consolidation, where multiple debts are combined into one with potentially lower interest rates, or debt renegotiation, which involves negotiating new terms directly with creditors. It’s a complex process that requires understanding legal rights and options available through entities like the National Credit Act. With proper guidance, individuals can navigate this path to a debt-free future in South Africa.

Common Types of Debt and Their Restructuring Options

Many individuals in South Africa struggle with various types of debt, each requiring unique strategies for effective management and restructuring. Common forms include credit card debt, personal loans, overdrafts, and mortgage bonds. For credit card debt, restructuring often involves negotiating with creditors to lower interest rates or fees, extending repayment terms, or consolidating multiple cards into one with more favorable conditions.

When it comes to personal loans and overdrafts, individuals can explore options such as refinancing through banks or financial institutions, which may offer lower interest rates and more flexible repayment plans. For complex cases involving mortgage bonds, debt restructuring might include refinancing to secure better terms, extending the bond term, or even negotiating with the bank for a partial write-off, though this is more rare. Debt restructuring should always be tailored to the individual’s financial situation and goals.

The Process: Steps to Effective Debt Restructuring

Debt restructuring for individuals is a strategic process designed to help South Africans break free from overwhelming debt. It involves a series of steps aimed at creating a sustainable financial future. The initial step is assessing your current financial situation, understanding the types and amounts of debts you carry, and identifying areas where adjustments can be made. This often includes evaluating income, expenses, and any assets or properties.

Once your financial landscape is clear, the next phase focuses on communicating with creditors. This involves negotiating with them to restructure your debt, which may include lowering interest rates, extending repayment terms, or even consolidating multiple debts into one manageable loan. It’s crucial to maintain open lines of communication throughout this process, ensuring all agreements are in writing for transparency and future reference. Effective debt restructuring ultimately empowers individuals to regain control over their finances and move towards a debt-free life.

Benefits and Challenges: Breaking Free from Debt

Breaking free from debt offers individuals in South Africa a new lease on financial freedom, but it’s not without its challenges. One of the key benefits is improved financial stability and peace of mind. Once out of debt, individuals can better manage their money, save for the future, and make significant purchases without being burdened by repayments. This freedom allows them to focus on other important aspects of life, such as investing in education or pursuing passions.

However, navigating the path to debt-free living is not always straightforward. Many South Africans face challenges like complex debt cycles, high-interest rates, and lack of financial literacy, which can make breaking free a daunting task. The process requires discipline, careful planning, and often professional guidance to restructure debts effectively. Despite these hurdles, achieving financial independence through successful debt restructuring remains an attainable goal for those committed to transforming their financial landscape.

Debt restructuring offers South Africans a promising path towards financial freedom. By understanding the various types of debt, their associated options, and following a structured process, individuals can navigate their way out of debt effectively. While challenges exist, the benefits of debt-free living far outweigh the obstacles, making it a crucial step towards securing a brighter financial future for all South Africans. Debt restructuring is not just a solution; it’s a gateway to financial stability and peace of mind.