Debt restructuring for individuals in South Africa offers a lifeline for those burdened by multiple debts and high-interest rates. By leveraging options like debt consolidation, settlement negotiations, and management plans from credit counseling organizations, debtors can create more manageable repayment schedules, regain financial stability, and avoid defaulting on their loans, providing much-needed relief and empowering them to effectively navigate their financial challenges.

In South Africa, individual debt restructuring plays a pivotal role in alleviating financial strain. This process offers a lifeline for those burdened by unmanageable debts, providing a structured path towards economic recovery. Understanding debt restructuring is essential as it empowers individuals to take control of their finances.

This article demystifies the concept, exploring various types of restructurings available to South Africans and outlining the step-by-step process, including the role of credit counsellors and legal protections, ensuring a comprehensive guide for those seeking debt relief.

- Understanding Individual Debt Restructuring in South Africa

- – Definition and significance of debt restructuring for individuals

Understanding Individual Debt Restructuring in South Africa

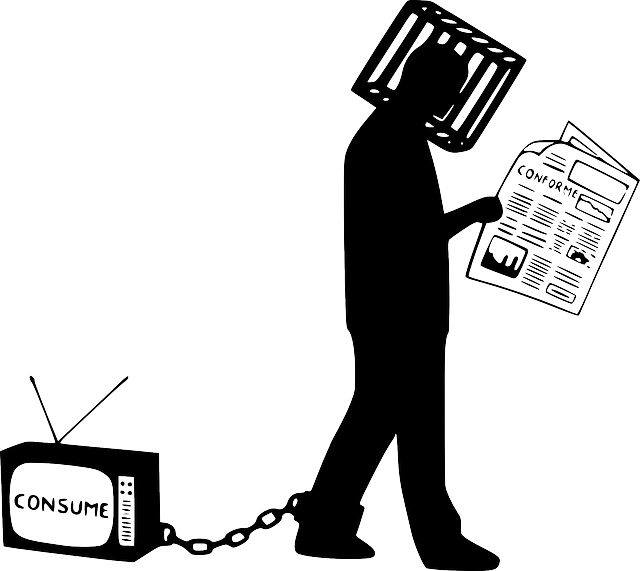

Individual debt restructuring in South Africa refers to a process where individuals facing financial difficulties can rearrange or reduce their debts. This is particularly beneficial for those burdened by multiple creditors, high-interest rates, or unforeseen expenses. The primary aim of debt restructuring is to provide debtors with a more manageable repayment plan, ultimately helping them regain financial stability and avoid the potential consequences of defaulting on their loans.

In South Africa, various forms of individual debt restructuring are available, including debt consolidation, where multiple debts are combined into one with potentially lower interest rates; debt settlement negotiations with creditors to reduce the overall debt amount; and debt management plans offered by credit counselling organisations that help individuals allocate income towards repayments while adhering to their financial capabilities. These options offer much-needed relief for South Africans grappling with overwhelming debt, enabling them to navigate their financial challenges more effectively.

– Definition and significance of debt restructuring for individuals

Debt restructuring for individuals is a financial process that allows persons burdened by debt to reorganise and manage their debts more effectively. It involves negotiating with creditors to alter the terms of existing loans, such as reducing interest rates, extending repayment periods, or consolidating multiple debts into one manageable loan. This process offers a lifeline to those facing overwhelming debt, helping them regain control over their finances.

The significance of debt restructuring lies in its ability to provide individuals with a chance for financial fresh start. By restructuring debts, people can reduce monthly payments, lower interest costs, and potentially avoid the negative consequences of defaulting on loans. This, in turn, can help improve credit scores, stabilise household budgets, and alleviate the stress and anxiety associated with chronic debt burden.

Debt restructuring for individuals in South Africa offers a much-needed lifeline for those burdened by financial stress. By understanding this process, which involves renegotiating terms with creditors to create a more manageable repayment plan, individuals can take control of their finances and avoid the spiraling effects of debt. This article has explored the definition, significance, and key aspects of this powerful tool, empowering South Africans to navigate their financial challenges effectively.