In South Africa, where financial literacy disparities exist, understanding how to recognize Ponzi schemes is crucial for investor protection. Key indicators include unrealistic returns with no genuine investment, a pyramid structure reliant on new members' funds, and aggressive sales tactics using complex jargon. To avoid these traps, investors should verify opportunities through official channels, consult regulatory bodies like the Financial Sector Conduct Authority (FSCA), and seek independent advice. If suspicious activities are spotted, be cautious and report them to relevant authorities. Recent high-profile cases highlight common signs like unrealistic returns, lack of transparency, and emphasis on recruiting new members.

In South Africa, as across the globe, Ponzi and pyramid schemes pose significant risks to investors. Understanding these fraudulent structures is paramount for financial safety. This article explores how to recognise a Ponzi scheme in South Africa, delving into common indicators of such scams and providing real-world case studies. Additionally, we offer practical advice on protecting yourself if you suspect a fraudulent investment opportunity.

- Understanding Ponzi and Pyramid Schemes in South Africa

- Common Indicators of a Fraudulent Scheme

- Protecting Yourself: What to Do If You Suspect a Scam

- Case Studies: Real-World Examples of Ponzi Schemes in SA

Understanding Ponzi and Pyramid Schemes in South Africa

In South Africa, as in many other countries, Ponzi and pyramid schemes pose a significant risk to investors. These fraudulent investment models promise high returns with minimal risk, attracting unsuspecting individuals seeking financial gains. However, understanding how to recognise a Ponzi scheme is crucial for safeguarding against such scams.

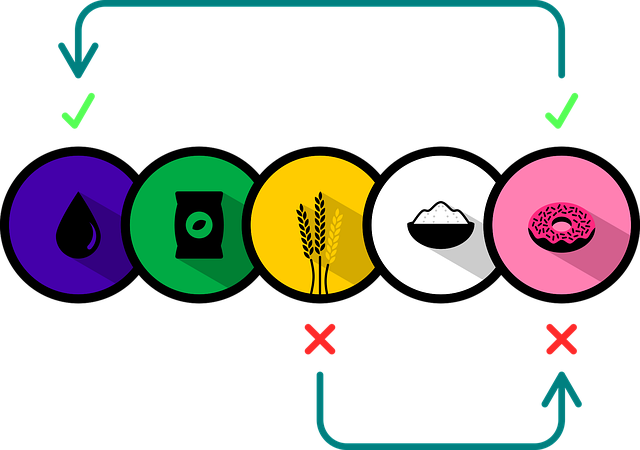

One of the key indicators is the absence of genuine investment or income generation. Often, these schemes offer unrealistic returns with little to no underlying asset or business model to support them. Investors may be prompted to recruit new members to fund the supposed investments, creating a pyramid structure. In South Africa, where financial literacy is essential, staying informed and vigilant is how to recognise a Ponzi scheme. Being cautious of too-good-to-be-true promises and thoroughly researching any investment opportunity before committing funds can significantly reduce the risk of becoming entangled in these deceptive schemes.

Common Indicators of a Fraudulent Scheme

Many investors in South Africa have fallen victim to fraudulent schemes like Ponzi and pyramid structures, losing substantial amounts of money. Understanding how to recognise these schemes is crucial for protecting your investments. One of the most common indicators of a Ponzi scheme is the promise of unusually high returns with little or no risk. If an investment opportunity guarantees extraordinary profits, especially in a short period, it’s a red flag. These schemes often attract investors by offering rewards that far exceed what is typically available in the market.

Another sign to watch out for is pressure tactics and high-pressure sales methods. Fraudsters may employ aggressive sales techniques, encouraging immediate decisions with limited time offers. They might also use complex jargon to make their scheme seem legitimate when it’s not. In South Africa, where financial literacy varies, it’s essential to seek independent advice or consult regulatory bodies if you suspect an investment is fraudulent. Always verify the legitimacy of opportunities through official channels and trusted sources.

Protecting Yourself: What to Do If You Suspect a Scam

If you suspect that you or someone else might be involved in, or a victim of, a Ponzi or pyramid scheme in South Africa, it’s crucial to take immediate action to protect yourself and your finances. These schemes often prey on investors’ hopes for high returns with little risk, so staying vigilant is key. Start by gathering all the relevant information about the investment opportunity: understand the return promises, how the money is supposed to be made, and who is behind the scheme.

Check if the company or individual is registered with the appropriate regulatory bodies in South Africa, such as the Financial Sector Conduct Authority (FSCA). The FSCA provides resources and guidelines on how to recognise a Ponzi scheme, including red flags like unrealistic returns, a lack of transparency about how investments are used, and high-pressure sales tactics. If you spot any of these signs, be wary. Report suspicious activities to the FSCA or local law enforcement to help prevent others from falling victim to such scams.

Case Studies: Real-World Examples of Ponzi Schemes in SA

In South Africa, several high-profile cases have shed light on how to recognise a Ponzi scheme. One notable example is the Gold Circle Investment Scheme, which promised investors returns on their gold deposits, but instead used new investors’ funds to pay off earlier participants. This fraudulent practice, often veiled as an investment opportunity, has duped countless individuals across the country. Another case involves a tech startup that claimed to be revolutionising online payments, attracting investors with promises of substantial returns in a short time frame. However, when authorities investigated, they found no legitimate business operations and only a web of complex lies.

These real-world examples highlight common signs of Ponzi schemes: unrealistic investment returns, lack of transparency, and an emphasis on recruiting new members to sustain the scheme. How to recognise a Ponzi Scheme in South Africa involves scrutinising investment opportunities that promise unusually high returns with little or no risk. Be wary of pressure tactics, such as demanding immediate action or threatening to pull out funds. Always conduct thorough research, verify the legitimacy of the company, and consult regulatory bodies before investing any money.

Understanding and recognizing Ponzi and pyramid schemes is crucial for protecting your financial well-being in South Africa. By being aware of common indicators like unrealistic returns, pressure to invest quickly, and lack of transparency, you can avoid falling victim to these fraudulent schemes. If you suspect a scam, it’s important to act promptly by reporting your concerns to the relevant authorities and seeking professional advice. Learning from real-world case studies can serve as a powerful reminder of the dangers these schemes pose. By following the guidelines outlined in this article, you’ll be better equipped to recognize and avoid Ponzi schemes in South Africa, thereby safeguarding your hard-earned money.