Inheritance planning near me is a strategic, personalized estate management process that goes beyond writing a will, addressing legal & financial complexities, ensuring peace of mind, and safeguarding your legacy. It involves evaluating your financial situation, setting goals, drafting legal documents like wills, powers of attorney, and trusts, and distributing assets according to your priorities while potentially reducing tax liabilities. Engaging the right professionals – lawyers, accountants, and financial advisors with relevant experience and certifications – is crucial for effective inheritance planning near me, ensuring clear communication and tailored services meet your specific needs.

Estate planning is a crucial aspect of ensuring your assets are distributed according to your wishes after your passing. Effective inheritance planning allows you to safeguard your legacy, minimize tax burdens on your heirs, and provide peace of mind.

This guide breaks down four essential steps: understanding inheritance planning’s benefits, creating an estate plan, choosing the right professionals, and ensuring it aligns with local laws, particularly “Inheritance Planning Near Me.”

- Understanding Inheritance Planning and Its Benefits

- Key Steps to Create a Comprehensive Estate Plan

- Finding the Right Professionals for Your Needs

Understanding Inheritance Planning and Its Benefits

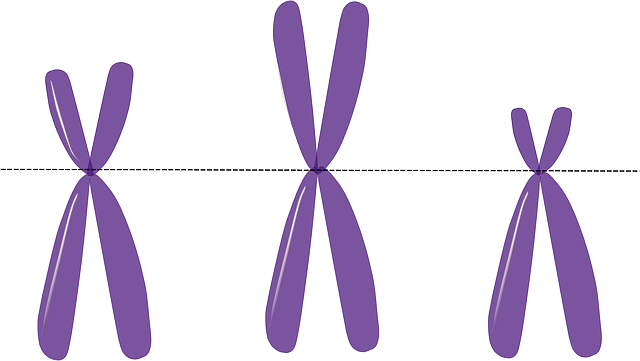

Inheritance planning is a critical aspect of estate management that involves strategic distribution of assets and property to beneficiaries upon your passing. It’s more than just writing a will; it’s a comprehensive process tailored to your unique circumstances, ensuring your wishes are respected while minimising potential legal and financial complexities for your loved ones. By proactively addressing inheritance matters, individuals can safeguard their legacy, provide for family members or charitable causes, and even reduce potential tax liabilities.

Effective inheritance planning near me allows you to make informed decisions about your future, choosing the right recipients and determining how your assets will be divided. It offers peace of mind, knowing that your affairs are in order and that your wishes will be carried out according to your preferences. This process is essential for individuals who wish to leave a meaningful legacy, protect their loved ones from unnecessary burdens, and ensure their hard-earned wealth contributes positively to future generations.

Key Steps to Create a Comprehensive Estate Plan

Creating a comprehensive estate plan is a crucial step in ensuring your wishes are respected and your assets distributed according to your desires after your passing. The key lies in taking a systematic approach, which involves several essential steps. Firstly, evaluate your current financial situation, including assets, liabilities, and income sources. This step is vital as it provides a clear picture of what you own and owe, enabling informed decision-making.

Secondly, identify your goals and priorities for inheritance planning near me. Consider who should benefit from your estate and in what amounts. You may wish to provide for family members, support charitable causes, or even create a trust for future generations. Once these objectives are clear, you can start crafting the legal documents that will bring your plan to life, such as a last will and testament, power of attorney, and any necessary trusts.

Finding the Right Professionals for Your Needs

When it comes to complex matters like inheritance and estate planning, engaging the right professionals is paramount. The process involves navigating intricate legal and financial landscapes, so it’s crucial to find experts who can guide you through every step. Start by seeking referrals from trusted sources—friends, family, or even your primary care physician. They may recommend lawyers, accountants, and financial advisors with a proven track record in inheritance planning near me.

Additionally, look for professionals who specialize in estate planning and have experience handling cases similar to yours. Ensure they possess the necessary certifications and stay updated on the latest legal developments. Effective communication is key; choose individuals who can explain technical concepts clearly and tailor their services to your specific needs and preferences.

Effective inheritance planning is not just about securing your assets; it’s about ensuring peace of mind and providing for future generations. By understanding the benefits, taking proactive steps to create a comprehensive estate plan, and enlisting the right professionals, you can navigate this process with confidence. Remember, knowledgeable guidance from an inheritance planning expert near you can make all the difference in achieving your desired outcomes.