Understanding South Africa's current inheritance tax rates is crucial for effective estate planning, as they significantly impact beneficiaries' tax liabilities. The rates, administered by SARS, vary based on estate value and beneficiary relationship, with substantial exemptions for direct descendants and spouses. By knowing these rates, individuals can make informed decisions to minimize tax burdens, ensure efficient asset transfer, and preserve wealth through strategic planning like lifetime gifts and trust structures.

In 2023, understanding South Africa’s inheritance tax rates is crucial for both individuals and families planning their estates. This guide provides a comprehensive overview of the current inheritance tax laws, including different tax rates applicable to various scenarios, exemptions, deductions, and calculation methods. By exploring these aspects, you can effectively plan ahead to minimize tax liability and ensure a smooth transfer of assets. Stay informed with the latest 2023 South Africa inheritance tax rates for smarter financial decisions.

- Understanding Inheritance Tax in South Africa: An Overview

- Current Tax Rates for Different Inheritance Scenarios

- Exemptions and Deductions: What's Not Subject to Tax?

- Calculating Inheritance Tax: A Step-by-Step Guide

- Planning Ahead: Strategies to Minimize Tax Liability

Understanding Inheritance Tax in South Africa: An Overview

Inheritance tax in South Africa is a complex topic, but understanding it is crucial for individuals looking to plan their estates effectively. The current inheritance tax rates in South Africa are designed to ensure fairness and equity among citizens, with different tax brackets applicable based on the value of the estate. These rates can significantly impact how much tax beneficiaries pay when receiving an inheritance.

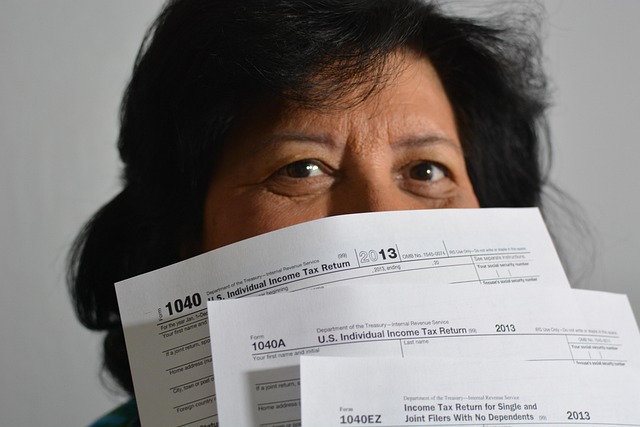

The South African Revenue Service (SARS) administers inheritance tax, which is levied on the transfer of property or assets upon death. The tax applies to a wide range of assets, including real estate, investments, and personal possessions. Knowing these current inheritance tax rates can help individuals make informed decisions regarding their financial planning and ensure that their wishes are carried out efficiently while minimizing tax liabilities for their loved ones.

Current Tax Rates for Different Inheritance Scenarios

In South Africa, inheritance tax rates vary depending on several factors, including the relationship between the deceased and the beneficiary, as well as the value of the inheritance. According to the current legislation, for direct descendants like children, stepchildren, and adopted children, no inheritance tax is payable if the inheritance is valued at R20 million or less. For siblings, nieces, and nephews, the threshold is R30 million.

For other relationships and scenarios, the tax rates kick in at different values. For example, for spouses and civil partners, there’s an exemption of up to R50 million. Above this amount, a progressive tax rate applies, starting at 20% on the excess value. For close friends and other beneficiaries not related by blood or marriage, a flat rate of 25% is charged on the entire inheritance amount above R30 million. These current inheritance tax rates in South Africa ensure fairness while allowing for some significant exemptions to support family legacies.

Exemptions and Deductions: What's Not Subject to Tax?

In South Africa, the current inheritance tax rates are designed to ensure fairness while considering the unique financial circumstances of each individual and family. When it comes to exemptions and deductions, there are several aspects that are not subject to tax under the current inheritance tax laws. This includes assets passed on to direct descendants such as children, grandchildren, and spouses. Additionally, personal effects like clothing, jewelry, and other sentimental items typically fall outside the taxable scope.

Further deductions are available for specific expenses related to the administration of the estate, including legal fees, funeral expenses, and any other costs incurred during the process of transferring assets to beneficiaries. These exemptions and deductions aim to provide relief from the inheritance tax burden, ensuring that families can preserve more of their legacy and wealth transfer without significant government intervention.

Calculating Inheritance Tax: A Step-by-Step Guide

Calculating inheritance tax in South Africa involves a step-by-step process that considers various factors, including the current inheritance tax rates and the value of the estate. The first step is to determine the taxable estate, which includes all assets passed on from the deceased person. This can encompass property, investments, personal belongings, and financial accounts. Once the taxable estate is identified, you must subtract any applicable deductions, such as debts, funeral expenses, and certain gifts made during the deceased’s lifetime. These deductions help to reduce the overall value subject to taxation.

After deducting these expenses, you then apply the relevant current inheritance tax rates in South Africa based on the remaining taxable amount. The tax rates vary depending on how much is inherited and who the beneficiary is. For example, close family members like spouses, children, or parents may face lower tax brackets than distant relatives or non-family members. Understanding these rates and following a systematic approach ensures compliance with South African tax laws and helps in managing the inheritance tax obligations efficiently.

Planning Ahead: Strategies to Minimize Tax Liability

In light of the current Inheritance Tax Rates in South Africa, savvy individuals can take proactive steps to minimize their tax liability and ensure a smoother transfer of assets upon their passing. One key strategy involves careful asset planning, such as restructuring ownership or utilizing available exemptions and deductions. For example, gifts made during one’s lifetime may be exempt from inheritance tax under specific conditions, providing an effective way to reduce the overall taxable estate.

Additionally, understanding the different tax brackets is essential. In 2023, South Africa employs a progressive tax system, with higher rates applying to larger estates. By structuring assets in a tax-efficient manner, such as setting up trusts or utilizing life insurance policies, individuals can ensure their loved ones face lower tax burdens when inheriting property and investments. These strategies not only help in preserving wealth but also allow for greater financial security during one’s lifetime.

Understanding and navigating South Africa’s inheritance tax landscape is essential for both citizens and non-residents planning their estate. This article has provided a comprehensive guide to the current 2023 inheritance tax rates, highlighting the diverse scenarios that apply. By exploring exemptions, deductions, and practical steps for calculation, individuals can make informed decisions to minimize their tax liability. When planning ahead, considering strategic options can significantly impact overall tax outcomes. Stay informed about these evolving regulations to ensure your estate is in compliance with the current inheritance tax rates in South Africa.