Ponzi schemes, a global fraud, target SA investors with false high-return promises, using new investor funds instead of profits. To avoid these scams, South Africans should watch for red flags, educate themselves, consult regulated advisors, verify opportunities through SASCOC, diversify portfolios, and stay informed about scams.

“Ponzi Schemes in South Africa: A Warning to Investors” delves into the insidious world of fraudulent investment schemes, specifically focusing on Ponzi structures prevalent in the country. This article breaks down the basic mechanics and red flags associated with these schemes, tracing their historical presence in South Africa and the lessons learned from past incidents. Additionally, it equips investors with essential strategies to safeguard their finances and avoid becoming unsuspecting victims of these deceptive Ponzi Schemes in South Africa.”

- Understanding Ponzi Schemes: The Basic Structure and Red Flags

- A History of Ponzi Schemes in South Africa: Past Incidents and Lessons Learned

- Protecting Yourself: Strategies for Investors to Avoid Becoming Victims of Ponzi Schemes

Understanding Ponzi Schemes: The Basic Structure and Red Flags

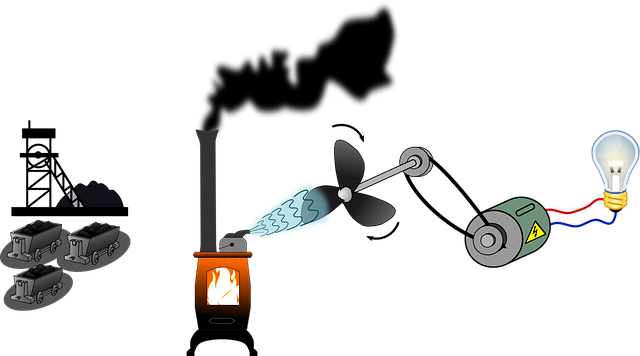

Ponzi schemes, often seen in the global financial landscape, have also made their way to South Africa, leaving investors wary and vulnerable. At its core, a Ponzi scheme is an investment fraud where returns are paid to existing investors from funds contributed by new investors, rather than from any actual profit earned. This creates a false impression of success and attracts more investors, who in turn fund the operation, creating a cycle that eventually collapses when new investments dry up.

Red flags that may indicate a Ponzi scheme include high-return promises with little to no risk, a lack of transparency regarding how funds are invested, and pressure to invest quickly or face missing out on opportunities. In South Africa, where investors are increasingly diversifying their portfolios, it’s crucial to stay vigilant against such schemes, especially as they often mimic legitimate investment opportunities. Staying informed and consulting regulated financial advisors can help protect investors from these deceptive practices specific to Ponzi Schemes in South Africa.

A History of Ponzi Schemes in South Africa: Past Incidents and Lessons Learned

Ponzi schemes have a long history in South Africa, with incidents dating back to the early 2000s. These fraudulent investment plans often promise high returns with minimal risk, attracting unsuspecting investors. One notable case occurred in 2008, where a company promised substantial returns on property investments, luring in many eager participants only to collapse, leaving investors with significant losses.

Lessons learned from past incidents highlight the importance of investor education and vigilance. South Africa’s financial regulators have since implemented measures to combat these schemes, including stricter oversight and awareness campaigns. However, as history has shown, Ponzi schemes can be sophisticated and hard to detect, emphasizing the need for investors to remain cautious and thoroughly research any investment opportunities before committing their funds.

Protecting Yourself: Strategies for Investors to Avoid Becoming Victims of Ponzi Schemes

Protecting yourself from Ponzi schemes in South Africa requires a combination of vigilance, research, and caution. As an investor, it’s crucial to understand that legitimate investments rarely promise unrealistic returns with little or no risk. If an opportunity seems too good to be true, it probably is. Always verify the legitimacy of investment opportunities by checking registered companies through regulatory bodies like the South African Securities Commission (SASCOC). Diversifying your portfolio can also help mitigate risks; spreading investments across various sectors and asset classes makes it less likely that you’ll suffer significant losses if one scheme fails.

Another strategy is to seek independent advice from financial experts or consult public resources that provide insights into suspected fraudulent activities. Stay informed about recent scams and be wary of high-pressure sales tactics or promises of guaranteed returns. Remember, patience is key; true wealth accumulation takes time, and legitimate investments require a long-term perspective. By adopting these precautions, investors can better protect themselves from the allure of Ponzi schemes in South Africa.

Ponzi Schemes in South Africa pose a significant risk to investors, as evidenced by historical incidents and the need for constant vigilance. By understanding the basic structure and red flags of these schemes, and adopting protective strategies, investors can significantly reduce their vulnerability. Staying informed and being cautious when it comes to high-return investment opportunities is crucial in navigating the financial landscape in South Africa and beyond. Recognizing Ponzi Schemes as a potential threat allows investors to make informed decisions, protecting their assets and ensuring a more secure future.