Ponzi schemes in South Africa are investment frauds promising high returns with low risk, using new investor funds to pay early participants. These schemes operate discreetly, often targeting vulnerable or inexperienced investors, but their unsustainable models ultimately collapse, causing substantial losses. To protect yourself from Ponzi schemes, be alert for extravagant promises, lack of transparency, and pressure tactics. Verify legitimacy through regulatory bodies like the NFPCA, educate yourself about investment types, practice diversification, and conduct thorough research before investing.

In the complex world of investments, understanding potential pitfalls is crucial. This article delves into the enigmatic realm of Ponzi Schemes in South Africa, providing a comprehensive guide for investors. We demystify these fraudulent schemes with a basic breakdown, highlight red flags specific to SA opportunities, and explore historical cases that shed light on their devastating impact. By equipping readers with knowledge, we empower them to protect themselves and navigate investments wisely in the local context.

- Understanding Ponzi Schemes: A Basic Breakdown

- Red Flags to Spot in South African Investment Opportunities

- Historical Examples of Ponzi Schemes in SA and Their Impact

- Protecting Yourself: What You Need to Know Before Investing

Understanding Ponzi Schemes: A Basic Breakdown

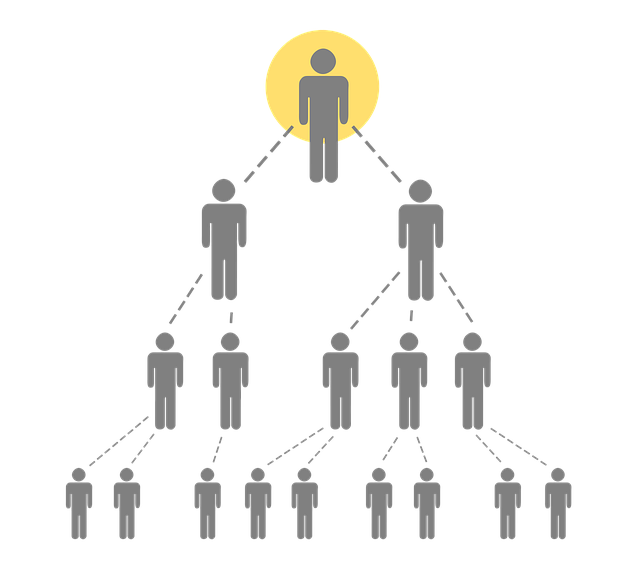

In simple terms, a Ponzi scheme is an investment fraud where early investors are paid returns with money from later investors, rather than from any actual profit earned. It’s a classic example of a house of cards, built on the illusion of lucrative investments. This scheme often promises high returns with little or no risk, attracting unsuspecting individuals looking to grow their wealth quickly. What makes Ponzi schemes particularly dangerous in South Africa is their potential to devastate investors, especially those who are financially vulnerable or unfamiliar with these deceptive practices.

Understanding how they operate is crucial for spotting red flags. Typically, organizers use the money from new investors to pay off early participants, creating a false impression of success and generating more interest. However, this model cannot sustain itself indefinitely, as it requires a constant influx of new investors. Once the flow of new funds dries up, the scheme collapses, leaving many investors with significant losses. By staying informed about these schemes and their tactics, investors in South Africa can protect themselves from becoming victims of such fraudulent activities.

Red Flags to Spot in South African Investment Opportunities

When evaluating investment opportunities in South Africa, it’s crucial to remain vigilant as the country has seen a rise in Ponzi schemes. Some red flags to look out for include excessive promises of high returns with minimal risk, which are often too good to be true. Scammers may also use complex jargon or pressure tactics to push investments, attempting to obscure the scheme’s unsustainable nature.

Additionally, be wary of opportunities that lack transparency in their operations or refuse to provide detailed financial statements. Unregistered investment schemes and those using offshore accounts are further indicators of potential fraud. Remember, legitimate investments should offer clear, verifiable information about the company’s history, leadership, and financial standing.

Historical Examples of Ponzi Schemes in SA and Their Impact

In the history of South Africa, there have been several notable instances of Ponzi schemes that have left a significant impact on investors and the economy. One of the most famous cases dates back to the early 2000s when a scheme promised high-return investments in real estate, attracting thousands of investors. However, it was later exposed as a fraud, with the operator using new investor funds to pay off previous participants, a classic characteristic of Ponzi schemes. Another example occurred in the financial sector, where a local investment company offered seemingly lucrative returns on savings accounts, enticing many South Africans to invest their hard-earned money. Unfortunately, this turned out to be another sophisticated Ponzi scheme, leading to widespread financial loss and a severe dent in public trust.

These historical examples serve as reminders of the insidious nature of Ponzi schemes, which often target vulnerable investors seeking better returns. The impact of such fraudulent activities is far-reaching, causing panic, eroding investor confidence, and potentially destabilizing the financial markets. In South Africa, where economic inequality is a persistent issue, these schemes can disproportionately affect lower-income individuals who are drawn to quick wealth accumulation promises. Understanding historical cases and their consequences is crucial in recognizing potential red flags and empowering investors to make informed decisions to protect their finances from such fraudulent Ponzi schemes in South Africa.

Protecting Yourself: What You Need to Know Before Investing

Before diving into any investment opportunity, especially those promising high returns with little risk, it’s crucial to understand how to protect yourself from Ponzi schemes in South Africa. These fraudulent schemes often prey on investors’ hopes for quick profits and can have devastating consequences once they unravel. Familiarize yourself with red flags like unrealistic return promises, lack of transparency about investment strategies, and pressure to act immediately. Always verify the legitimacy of the investment opportunity through regulatory bodies like the National Financial Planning and Conduct Authority (NFPCA).

Educate yourself on different types of investments and their associated risks. Diversification is a key strategy to mitigate risk. Be wary of high-pressure sales tactics or promises of guaranteed returns. Take your time to thoroughly research any investment, consult with financial advisors if needed, and never invest funds you can’t afford to lose. Protecting yourself starts with knowledge and due diligence.

In navigating the complex landscape of investments, being vigilant against Ponzi schemes is paramount. By recognizing the warning signs detailed in this article, such as unrealistic returns and a lack of transparency, residents of South Africa can protect their hard-earned money. Understanding historical examples and arming yourself with knowledge from reliable sources is crucial to fostering a robust and secure investment environment. Stay informed, question offers that seem too good to be true, and always verify the legitimacy of investment opportunities to avoid falling victim to Ponzi Schemes in South Africa.