Estate planning goes beyond wills, focusing on distributing assets according to your wishes post-passing while minimizing potential errors that could burden beneficiaries. Common mistakes arise from a lack of understanding or forethought, causing legal, financial, and emotional strain. Proactive planning involves clear family communication, professional advice, and tools like trusts. Neglecting trusts, tax consequences, and updating beneficiary designations are significant errors to avoid. Regularly reviewing and updating estate documents is crucial to prevent confusion and legal issues.

Avoiding common estate planning mistakes is crucial for effective inheritance management and ensuring your wishes are respected. This comprehensive guide highlights critical blunders, such as inadequate communication within families, mistrust in legal documents, tax oversight, outdated paperwork, and beneficiary neglect. Understanding these pitfalls empowers individuals to navigate the complexities of estate planning, optimizing asset distribution while minimizing potential conflicts or legal complications. Learn from others’ mistakes to build a robust inheritance plan.

- Understanding Inheritance Planning: The Foundation of Effective Estate Management

- Lack of Communication: A Common Pitfall in Family Wealth Transfer

- Omitting or Misusing Trusts: Navigating the Legal Complexities

- Failing to Address Tax Implications: Optimizing Your Estate for Efficiency

- Incomplete or Outdated Documents: Ensuring Your Intentions are Clearly Communicated

- Neglecting Beneficiary Designations: Protecting Your Assets and Intentions

Understanding Inheritance Planning: The Foundation of Effective Estate Management

Estate planning involves more than just creating a will; it’s about ensuring your wishes are carried out and your assets distributed according to your preferences after your passing. Inheritance planning, a crucial component, focuses on minimizing potential mistakes that could lead to unintended consequences for your beneficiaries. Common inheritance planning mistakes often stem from a lack of understanding or forethought, resulting in legal, financial, and emotional burdens for loved ones.

By proactively addressing inheritance planning, individuals can safeguard their legacy and avoid pitfalls such as excessive taxes, probate delays, and legal disputes. Effective strategies involve clear communication with family members, seeking professional advice, and utilizing available tools like trusts to manage and distribute assets efficiently. Understanding Inheritance Planning Mistakes is the first step towards building a robust estate management foundation, ensuring your wishes are respected while maximizing the benefits for those you leave behind.

Lack of Communication: A Common Pitfall in Family Wealth Transfer

In many families, discussing finances and inheritance plans is often considered taboo or uncomfortable. This silence can lead to significant mistakes in estate planning, especially when it comes to transferring wealth between generations. Lack of communication not only causes confusion but can also result in disputes among family members, ultimately undermining the intentions of the deceased. It’s crucial for families to have open conversations about their financial wishes and plans well in advance.

When inheritance planning, clear communication ensures that everyone involved understands the strategies, objectives, and potential outcomes. Regular discussions allow family members to ask questions, clarify roles, and ensure the plan aligns with individual expectations. By breaking the silence on these matters, families can avoid costly legal battles, emotional stress, and last-minute adjustments, ensuring a smoother transition of wealth according to the wishes of the individual.

Omitting or Misusing Trusts: Navigating the Legal Complexities

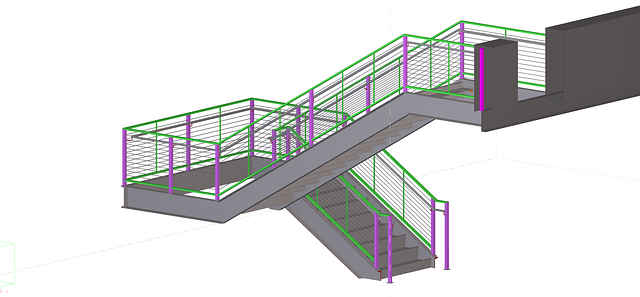

When considering inheritance planning mistakes, one of the most significant blunders individuals make is omitting or misusing trusts. Trusts are powerful legal tools designed to manage and distribute assets according to your wishes after your passing. However, their complexity can lead to unintended consequences if not set up or managed properly. For instance, a poorly crafted trust may result in excessive taxes, legal challenges, or even the disinheritance of intended beneficiaries.

Navigating the legal complexities of trusts requires careful consideration and expert guidance. Misusing trusts, such as using them for asset protection without proper structuring or failing to update them with changing circumstances, can create confusion and disputes among family members. It’s crucial to consult with an estate planning attorney who understands the intricacies of trust law in your jurisdiction to ensure your wishes are accurately reflected and that your assets are managed according to your inheritance planning goals.

Failing to Address Tax Implications: Optimizing Your Estate for Efficiency

When planning your estate, one common mistake many make is overlooking the significant tax implications that can arise. Inheritance planning mistakes often stem from a lack of understanding or consideration for how taxes will affect the transfer of assets. Without proper optimization, your carefully crafted estate plan could result in substantial losses for your intended beneficiaries.

To avoid this, consult with a financial advisor or attorney who specializes in estate law to ensure your plan is tax-efficient. Strategies like utilizing tax-advantaged accounts, implementing gift giving plans, and choosing the right trusts can significantly reduce tax burdens. By addressing these tax implications proactively, you can safeguard your legacy and ensure that more of your hard-earned assets make it to your chosen heirs.

Incomplete or Outdated Documents: Ensuring Your Intentions are Clearly Communicated

Incomplete or outdated estate planning documents can lead to significant inheritance planning mistakes, causing confusion and potential legal issues for your loved ones. It’s crucial to regularly review and update your will, trust, and any other relevant documents to ensure your intentions are clearly communicated. Life changes, such as marriages, divorces, births, deaths, and financial shifts, should prompt a reevaluation of your estate plan.

Neglecting this aspect can result in unwanted distributions, tax implications, or even disputes among beneficiaries. To avoid these inheritance planning mistakes, keep your documents current, clearly define property ownership, and consider consulting an experienced estate planning attorney to ensure your wishes are accurately reflected and legally sound.

Neglecting Beneficiary Designations: Protecting Your Assets and Intentions

Neglecting beneficiary designations is one of the most common inheritance planning mistakes. When you fail to update or review your beneficiary forms, especially on life insurance policies, retirement accounts, and bank accounts, your assets could end up in the wrong hands upon your passing. This can happen even if you have a comprehensive will in place, as these accounts bypass the probate process and directly disburse according to the designated beneficiaries. Regularly reviewing and updating these designations ensures your intentions are respected and your assets are protected.

This mistake often stems from assuming that beneficiary designations don’t need changing or forgetting to update them after significant life events like marriage, divorce, birth of a child, or even retirement. It’s crucial to make it a habit to check and adjust these designations periodically. Doing so can save your family from unnecessary stress and legal complications, ensuring your inheritance planning is as precise as possible.

Avoiding common estate planning mistakes is key to ensuring a smooth transition of your wealth. By understanding inheritance planning, communicating openly with family, seeking legal guidance on trusts and taxes, maintaining current documents, and carefully considering beneficiary designations, you can create a robust plan that reflects your intentions. Remember, proactive planning can prevent future complexities and ensure your legacy is managed as you wish.