Planning for a funeral is essential, as unexpected costs can add considerable stress to an already difficult time. With an average cost of $8,500 in the U.S., understanding and budgeting for these expenses is crucial. Insurance for funeral costs plays a strategic role in easing financial burdens, allowing individuals to control their final wishes both emotionally and financially. By pre-arranging services, researching cost-effective alternatives, and considering prepaid plans or insurance, families can say goodbye to loved ones without overwhelming expenses, ensuring a meaningful farewell.

“Saying goodbye to a loved one is never easy, but managing the financial aspect of funerals can add unnecessary stress. This comprehensive guide breaks down the often-overlooked expense of funeral costs, offering insights into budgeting and planning ahead. From cost-effective alternatives to the benefits of pre-paid funeral plans, we explore ways to navigate this delicate topic. Additionally, discover how insurance for funeral costs can provide peace of mind, ensuring your final wishes don’t leave a lasting financial burden.”

- Understanding Funeral Costs: An Overlooked Expense

- Budgeting for the Inevitable: Planning Ahead

- Exploring Cost-Effective Alternatives

- The Role of Pre-Paid Funeral Plans

- Insurance for Funeral Costs: Protection and Peace of Mind

- Leaving a Lasting Legacy Without Financial Burden

Understanding Funeral Costs: An Overlooked Expense

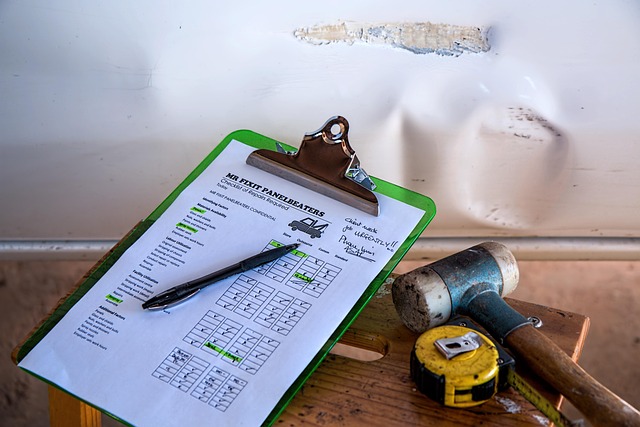

Saying goodbye to a loved one is never easy, and when faced with the task of organizing a funeral, many families are caught off guard by the unexpected expense. Funeral costs have long been an overlooked aspect of estate planning, but understanding these expenses is crucial for managing your financial legacy. From burial or cremation services to venue rental and floral arrangements, the bill can quickly add up. According to recent studies, the average funeral in the United States costs around $8,500, a figure that doesn’t include additional fees like cemeteries or crematorium charges.

One way to ease this financial burden is by considering insurance for funeral costs. This specialized coverage can help offset unexpected expenses, ensuring your family isn’t left with a substantial debt during an already challenging time. By planning ahead and exploring these options, individuals can take control of their final wishes, both in terms of commemoration and financial considerations.

Budgeting for the Inevitable: Planning Ahead

Saying goodbye to a loved one is never easy, but planning ahead can make this difficult time a little less financial burden. Budgeting for funeral costs is an essential step in ensuring that your final farewell is both meaningful and affordable. Many people put off thinking about insurance for funeral costs, but doing so allows you to pre-arrange and potentially save money in the long run.

By planning ahead, you can choose various options tailored to your needs and budget. This might include deciding on a basic or more elaborate service, selecting appropriate burial or cremation options, and considering additional expenses like flowers, catering, or memorial keepsakes. With careful consideration and research, it’s possible to find cost-effective solutions without compromising the quality of the send-off you wish to provide.

Exploring Cost-Effective Alternatives

Saying goodbye to a loved one doesn’t have to put a significant strain on your finances. Exploring cost-effective alternatives can help make this difficult process more manageable. One option to consider is insurance for funeral costs. These policies are designed to cover various expenses associated with funerals and memorials, providing peace of mind during an emotional time. They offer flexible plans tailored to different budgets, ensuring you don’t have to break the bank to honor your loved one’s memory.

Additionally, many cemeteries and funeral homes offer affordable services and packages. From simple burial or cremation options to more personalized ceremonies, there are choices available for every budget. Community resources and non-profit organizations may also provide financial assistance or low-cost services. By exploring these alternatives, you can find meaningful ways to say goodbye without the added stress of overwhelming expenses.

The Role of Pre-Paid Funeral Plans

Pre-paid funeral plans offer a practical and cost-effective solution for individuals looking to prepare for their final farewells. These plans provide peace of mind by covering funeral expenses, including burial or cremation costs, as well as services like embalming and transportation. By investing in insurance for funeral costs upfront, families can avoid the financial burden during an already emotional time.

This proactive approach allows individuals to customize their preferences and budget accordingly, ensuring their wishes are respected while protecting their loved ones from unexpected expenses. With various options available, pre-paid plans cater to different needs and budgets, making it easier for people to say goodbye without breaking the bank.

Insurance for Funeral Costs: Protection and Peace of Mind

Saying goodbye to a loved one is never easy, but proper planning can provide some measure of comfort during an emotional time. One often overlooked aspect of this process is ensuring financial protection for funeral costs, which can be a significant burden on families during what’s already a difficult period. Insurance for funeral costs offers peace of mind, knowing that these expenses will be covered, allowing families to focus on their grief rather than financial strain.

This type of insurance provides coverage for various funeral-related expenditures, including burial or cremation services, caskets, hearses, and even memorial products. By securing such insurance, individuals can ensure their final wishes are respected while also protecting their loved ones from unexpected financial obligations. It’s a proactive step that demonstrates consideration for both the living and the passing, making it an essential component of estate planning.

Leaving a Lasting Legacy Without Financial Burden

Many people worry about leaving a financial burden on their loved ones, especially when it comes to planning for the future and saying goodbye. However, ensuring your final wishes don’t strain your family’s finances is achievable without breaking the bank. One of the most significant steps towards this goal is securing insurance for funeral costs. This essential coverage provides peace of mind, knowing that your funeral expenses will be taken care of, allowing your loved ones to grieve without the added stress of financial worry.

By investing in a suitable policy, you can leave behind a lasting legacy without placing a financial strain on your family. There are various options available, catering to different budgets and needs, ensuring that you can find an affordable solution while still achieving your goals. This proactive approach allows you to focus on creating meaningful memories and connections while knowing that your final send-off will be handled with care.

In light of the above discussions, it’s clear that planning for funeral expenses doesn’t have to break the bank. By understanding the various costs involved, budgeting ahead, exploring cost-effective alternatives, considering pre-paid funeral plans, and ensuring adequate insurance coverage, you can say goodbye without leaving a financial burden on your loved ones. Remember, preparing for the inevitable is a thoughtful act that provides peace of mind, knowing your wishes will be respected while minimizing financial stress during an emotional time.