Unveiling Ponzi Schemes: Protecting South Africans from Financial Scams

In South Africa, understanding how to identify a Ponzi scheme is vital for protecting investments an…….

How To Recognise A Ponzi Scheme In South Africa

In the complex world of investments, one scheme has persistently plagued financial systems worldwide—the Ponzi scheme. Named after Charles Ponzi, who orchestrated one of the most famous frauds in history during the 1920s, this fraudulent investment model continues to evolve and adapt, posing a significant risk to investors, especially in South Africa’s dynamic economy. This article aims to demystify the art of recognizing a Ponzi scheme, empowering South African investors with the knowledge to protect their hard-earned money. We will delve into its defining characteristics, historical context, global impact, economic implications, and explore how technological advancements and policy interventions shape the landscape of this peculiar financial phenomenon.

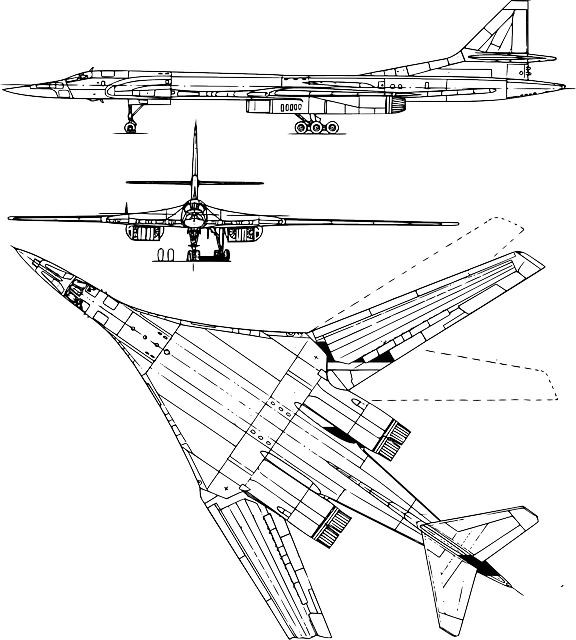

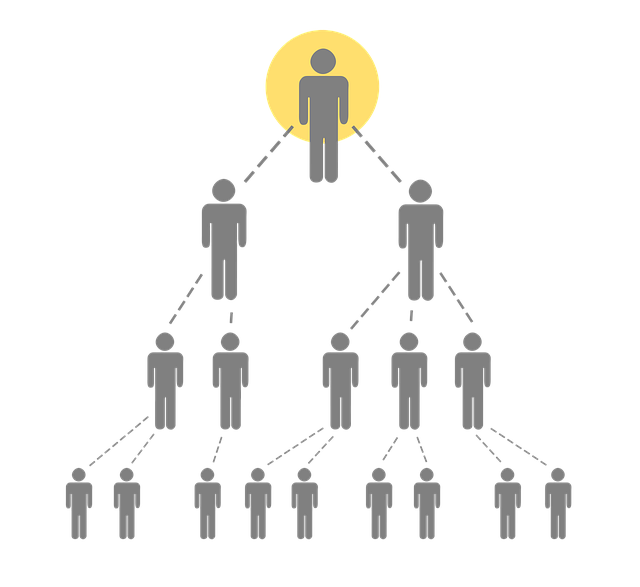

A Ponzi scheme is an investment fraud that promises high returns with little or no risk. It operates on a pyramid-like structure, where early investors are paid returns using the investments of new participants rather than any actual profit generated by the underlying business. This unsustainable model relies heavily on continuous inflows of new money to maintain the illusion of profitability. The scheme typically involves the following key components:

South Africa has witnessed several Ponzi schemes over the years, with some having significant impacts on investors. One notable example is the Pinnacle Scheme in the late 1990s, which enticed investors with promises of real estate investments and high returns. As the scheme collapsed, it left thousands of investors with substantial losses. This incident underscored the need for better investor protection and led to regulatory reforms aimed at identifying and preventing similar frauds.

Ponzi schemes are not bound by geographical borders; they have a profound global impact. According to a report by the Financial Action Task Force (FATF), an intergovernmental organization focused on combating money laundering, Ponzi schemes cost investors worldwide an estimated $6.5 billion annually. South Africa, being an integrated part of the global financial system, is susceptible to these schemes, with international fraudsters often targeting vulnerable local investors.

Ponzi schemes disrupt market dynamics by distorting investment patterns. They create artificial demand for investments, leading to speculative bubbles and unsustainable asset price inflation. When the scheme collapses, it results in a sudden reversal, causing significant economic losses for investors and potentially destabilizing financial markets.

Technological advancements play a dual role in the context of Ponzi schemes:

South Africa’s financial regulators have implemented robust measures to combat Ponzi schemes:

International collaboration is vital in combating Ponzi schemes due to their global nature. South Africa is an active participant in global efforts, contributing to the development of international standards and guidelines through organizations like FATF. These collaborations enhance the ability to share intelligence, track fraudulent activities across borders, and ensure consistent investor protection.

Not all investment opportunities are legitimate. Here are some signs that may indicate a potential Ponzi scheme:

As an investor, staying informed and adopting a cautious approach can significantly reduce your risk of falling victim to a Ponzi scheme. Here are some best practices:

Q: How can I tell if an investment is a Ponzi scheme?

A: Look for unusually high returns with little risk, a lack of transparency, and high-pressure sales tactics. Legitimate investments rarely offer such attractive returns without proportional risks.

Q: Are cryptocurrency investments safe from Ponzi schemes?

A: Cryptocurrencies present new opportunities but also new risks. While blockchain technology offers enhanced security, the speculative nature of cryptocurrencies makes them vulnerable to fraudulent activities. Always conduct thorough research before investing in any digital asset.

Q: What should I do if I think I’ve been a victim of a Ponzi scheme?

A: Contact the relevant authorities immediately, such as the FSCA or local police. Provide them with all available details and evidence to help investigate and recover potential losses.

Q: How can technology help prevent Ponzi schemes?

A: Advanced analytics, machine learning, and blockchain technology are powerful tools in detecting and preventing fraudulent activities. These technologies enable regulators and financial institutions to identify patterns and anomalies indicative of Ponzi schemes.

Q: Is it possible to recover losses from a Ponzi scheme?

A: Recovering losses from a Ponzi scheme can be challenging, but not impossible. Law enforcement agencies and regulatory bodies work to investigate and bring perpetrators to justice, which may lead to some recovery for victims. However, the success of such efforts varies.

In South Africa, understanding how to identify a Ponzi scheme is vital for protecting investments an…….

In South Africa, recognizing Ponzi schemes is vital for protecting investments. Look out for high, u…….

In South Africa, recognizing a Ponzi scheme involves caution against high-return investments with no…….

In South Africa, understanding how to recognize a Ponzi scheme is crucial for protecting your financ…….

In South Africa, Ponzi schemes offer high returns with minimal risk but are actually funded by new i…….

In vibrant South African financial markets, recognizing a Ponzi scheme is crucial for savvy investor…….

In South Africa, understanding how to recognize a Ponzi scheme is crucial for protecting your invest…….

Ponzi schemes in South Africa target investors with high-return promises, paying old investors with…….

Understanding Ponzi schemes is crucial for South African investors aiming to protect their financial…….