Historical Changes and Future Trends: South Africa’s Inheritance Tax Evolved

The evolution of inheritance tax in South Africa, from its introduction in 1925, has been influenced…….

In the intricate web of financial planning, inheritance tax stands as a pivotal consideration, especially within the context of South Africa’s unique economic and legal framework. This article aims to dissect and demystify this complex topic, offering readers a comprehensive understanding of inheritance tax as it operates in South Africa. We will explore its historical roots, global implications, economic ramifications, technological integrations, regulatory frameworks, challenges, real-world applications, and future trajectories. By the end of this journey, readers should grasp not only the what but also the why and how of inheritance tax within the South African landscape.

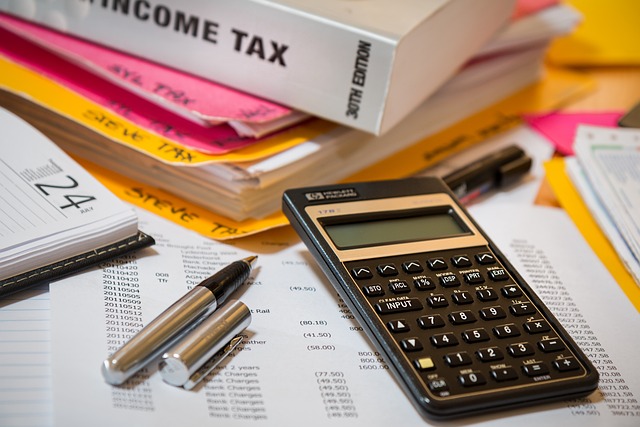

Inheritance tax, a fundamental aspect of estate planning, is a levy imposed by governments on the transfer of property or assets from a deceased individual to their heirs. In South Africa, this tax plays a pivotal role in generating revenue for the state while also serving as a mechanism to redistribute wealth and ensure fairness among successors. Central to its understanding is the concept of taxable estate, which refers to the total value of all assets owned by the decedent at the time of death.

Core Components:

Historical Context:

The history of inheritance tax in South Africa dates back to the early 20th century when colonial administrations began implementing estate duty to raise revenue. Over time, as the country evolved, so did its taxation policies. Significant reforms were introduced post-apartheid, aiming to simplify the system and address historical inequities. Today, inheritance tax stands as a critical component of South Africa’s tax structure, contributing substantially to government revenues.

The global impact of inheritance tax in South Africa is both multifaceted and interwoven with international trends. Understanding these influences provides valuable context for domestic policymakers and individuals navigating estate planning.

International Influence:

Key Trends Shaping Inheritance Tax:

Regional Variations:

Across different regions, inheritance tax rates and exemptions differ substantially:

| Region | Tax Rates (Example) | Exemptions |

|---|---|---|

| Europe | 0-45% (Varies by Country) | Spouses and Civil Partners often have higher exemption limits |

| North America | 10-40% | Basic Exemption for Spouse, Children, and Dependents |

| Asia Pacific | 5-35% | Varies by Country; Some offer no inheritance tax |

| South Africa | 0-22% (Progressive) | Basic Exemption for Close Relatives |

The economic landscape plays a critical role in shaping the effectiveness and perception of inheritance tax in South Africa. Understanding these dynamics is essential for both policymakers and individuals planning their financial futures.

Market Dynamics:

Economic Systems and Inheritance Tax:

Inheritance tax serves multiple functions within the economic system:

Technology has revolutionized various aspects of society, and inheritance tax is no exception. Digital tools and platforms are transforming the way assets are managed, valued, and transferred, leading to more efficient tax administration.

Technological Advancements:

The regulatory environment surrounding inheritance tax in South Africa is comprehensive and continually evolving. Understanding these regulations is crucial for both compliance and strategic planning.

Key Regulators:

Regulatory Changes:

Over the years, South Africa has implemented various reforms:

Despite its well-established framework, inheritance tax in South Africa faces several challenges that require ongoing attention and adaptation.

Common Challenges:

Understanding how inheritance tax plays out in practical scenarios offers valuable insights into its real-world impact.

Case Study 1: Family Business Transfer

A successful family-owned business, with assets spanning multiple industries, faced a complex inheritance tax scenario upon the death of the founder. By employing strategic planning, including gift taxes and trust structures, the family managed to minimize their tax burden while ensuring the business remained in family hands.

Case Study 2: Cross-Border Estate Planning

A South African citizen with significant global investments sought advice on inheritance tax implications for his international assets. With careful navigation of different tax jurisdictions and use of tax treaties, he was able to optimize his estate planning, avoiding unnecessary taxes.

The future of inheritance tax in South Africa is shaped by evolving economic landscapes, technological advancements, and global trends. Policymakers and taxpayers alike must remain agile and adaptable.

Emerging Trends:

Inheritance tax in South Africa is a dynamic and complex field, evolving alongside global trends and economic shifts. Understanding its intricacies empowers individuals and businesses to make informed decisions regarding estate planning and asset management. As the landscape continues to transform, staying informed and proactive will be key to navigating this critical aspect of financial planning.

The evolution of inheritance tax in South Africa, from its introduction in 1925, has been influenced…….

The current inheritance tax rates in South Africa vary by relationship, with rates ranging from 20%…….

The Current Inheritance Tax Rates in South Africa, administered by SARS, are a complex yet crucial a…….

The evolution of inheritance tax in South Africa has been a dynamic process since its introduction i…….

In South Africa, Inheritance Tax (Estate Duty) levies property transfers from the deceased to benefi…….

Estate planning strategies for inheritance tax involve understanding and minimizing tax liabilities…….

In South Africa, Inheritance Tax (Estate Duty) is calculated based on transferred asset values but o…….

The Current Inheritance Tax Rates in South Africa vary based on the relationship between the decease…….