Building A Secure Financial Future With Offshore Tax Strategies for South African Investors

South African investors can build a secure financial future by leveraging offshore tax planning. By…….

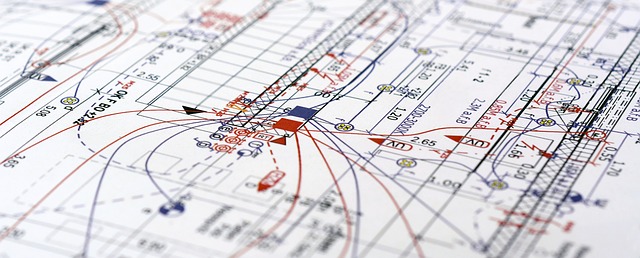

Offshore tax planning, a sophisticated strategy employed by individuals and corporations alike, involves structuring financial affairs in jurisdictions outside of one’s home country to optimize tax efficiency. This intricate process has evolved into a global phenomenon, shaping international business, investment flows, and the overall economic landscape. In this comprehensive article, we will embark on an in-depth exploration of offshore tax planning, unraveling its intricacies, analyzing its impact, and offering valuable insights for stakeholders worldwide. By the end of this journey, readers will grasp the significance of this practice, its historical roots, and its role in today’s interconnected global economy.

Offshore tax planning refers to the deliberate arrangement of financial affairs in low- or no-tax jurisdictions, also known as offshore financial centers (OFCs) or tax havens. It involves a strategic combination of legal entities, trust structures, and investment vehicles designed to minimize taxable income and reduce tax liabilities. The core components include:

The practice of offshore tax planning has deep historical roots, dating back centuries. Initially, individuals sought refuge from oppressive taxation in their home countries by establishing businesses or holding assets abroad. Over time, the development of international trade and financial markets fueled the growth of offshore centers, attracting investors with their favorable tax regimes.

Its significance lies in several key areas:

Offshore tax planning exerts a profound impact on the global economy and international relations. The flow of capital across borders, facilitated by these strategies, influences exchange rates, investment patterns, and the overall balance of payments. Furthermore, it can lead to competition among nations to offer more attractive tax regimes, shaping economic policies worldwide.

Offshore tax planning significantly influences global investment flows and market dynamics:

Technology has revolutionized offshore tax planning, enhancing efficiency and accessibility:

Ensuring compliance in offshore tax planning is a complex challenge for governments worldwide:

Offshore planning opens doors to diverse investment opportunities:

While offshore tax planning offers numerous benefits, it also carries risks and ethical considerations:

The future of offshore tax planning lies in enhanced international cooperation:

In conclusion, offshore tax planning is a complex and evolving field that presents opportunities and challenges alike. As technology advances and global cooperation strengthens, the future of offshore structuring and investment will be characterized by increased transparency, digital innovation, and ethical considerations. Professionals and businesses in this domain must stay informed and adapt to these changes to ensure compliance, mitigate risks, and contribute positively to a sustainable global economy.

South African investors can build a secure financial future by leveraging offshore tax planning. By…….

In South Africa, navigating offshore tax planning requires understanding complex regulations designe…….

Building a secure financial future through offshore tax planning involves strategically leveraging l…….

Offshore tax planning strategically leverages legal entities and jurisdictions outside your country…….

Building a secure financial future requires strategic planning, and offshore tax planning is a power…….

Offshore tax planning strategically navigates global tax systems to build a secure financial future……..

South Africans are increasingly turning to offshore tax planning to safeguard their financial securi…….

Offshore tax planning offers a strategic solution for individuals and businesses aiming Building A S…….

Offshore tax planning strategically optimizes finances by leveraging global tax laws and internation…….