In South Africa, Absa Bank, Standard Bank, and First National Bank (FNB) stand out for offering debt consolidation loans with flexible terms. When applying, thorough preparation is crucial: gather financial info, understand your credit history, determine the amount to consolidate, and compare bank offers based on interest rates and repayment conditions. Approach multiple banks for the best approval chances and terms, focusing on "Which Banks Offer Debt Consolidation Loans."

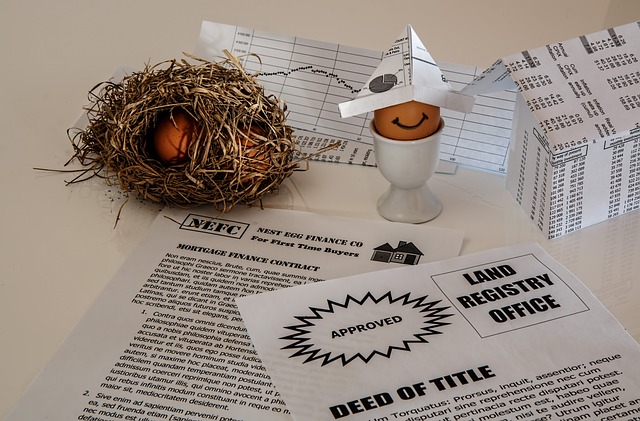

“Thinking of using debt consolidation loans to manage your debts in South Africa? Understanding the application process is crucial. This guide breaks down everything you need to know, focusing on which banks offer these loans and how to navigate the steps effectively. We’ll walk you through preparing your documents, applying, and consolidating your debts for better financial control. By following this step-by-step guide, you can make an informed decision about debt consolidation loans in South Africa.”

- Which Banks Offer Debt Consolidation Loans in South Africa?

- Preparing for the Application Process: What You Need to Know

- Step-by-Step Guide to Applying for a Debt Consolidation Loan

Which Banks Offer Debt Consolidation Loans in South Africa?

In South Africa, several banks offer debt consolidation loans as a solution for managing multiple debts. Among the prominent institutions providing this service are Absa Bank, Standard Bank, and First National Bank (FNB). These banks cater to diverse customer needs, offering tailored loan packages with flexible repayment terms.

Absa Bank, for instance, has a comprehensive range of debt consolidation options, allowing borrowers to combine various debts into one manageable repayment. Standard Bank also facilitates this process, ensuring customers can simplify their financial obligations. FNB provides similar facilities, enabling individuals to consolidate debts and potentially reduce interest expenses, thereby offering financial relief and improved cash flow management.

Preparing for the Application Process: What You Need to Know

When considering debt consolidation loans, preparing beforehand can significantly enhance your chances of a successful application. South African banks offer these loans as a way to simplify multiple debts into one manageable payment, but the process requires careful consideration and documentation. Gather all your financial information, including details of existing debts, income statements, and identification documents. This preparation ensures you have all the necessary elements when applying with banks that provide debt consolidation loans, such as Absa, Standard Bank, or First National Bank (FNB).

Understanding your credit history is also vital. Banks will assess your creditworthiness, so reviewing your credit report and addressing any discrepancies can improve your application’s outcome. Additionally, having a clear idea of the amount you wish to consolidate and the purpose behind it demonstrates thoughtful planning to lenders.

Step-by-Step Guide to Applying for a Debt Consolidation Loan

Applying for a debt consolidation loan in South Africa is a straightforward process, but it requires careful consideration and planning. Here’s a step-by-step guide to help you navigate the application journey with ease. Firstly, identify which banks offer debt consolidation loans, as not all financial institutions provide this service. Research reputable local banks known for their comprehensive debt management solutions. Once you’ve shortlisted a few options, compare their loan terms, interest rates, and repayment conditions.

Next, evaluate your financial situation by listing all your current debts and calculating your monthly cash flow. This step is crucial as it helps determine the loan amount suitable for your consolidation needs. Prepare necessary documents such as proof of identity, income statements, and details of existing loans. Ensure these are up to date and accurately reflect your financial standing. When applying, approach multiple banks to increase your chances of getting approved for the best terms.