Debt Consolidation Loans provide a strategic way to manage multiple debts by bundling them into one loan with lower interest rates and no hidden charges, offering transparency and simplified repayment. To apply, gather essential documents like financial statements and existing loan details, as lenders verify income and credit history during a thorough review period. Upon approval, borrowers receive personalized loan offers, gaining control over finances and potentially saving money.

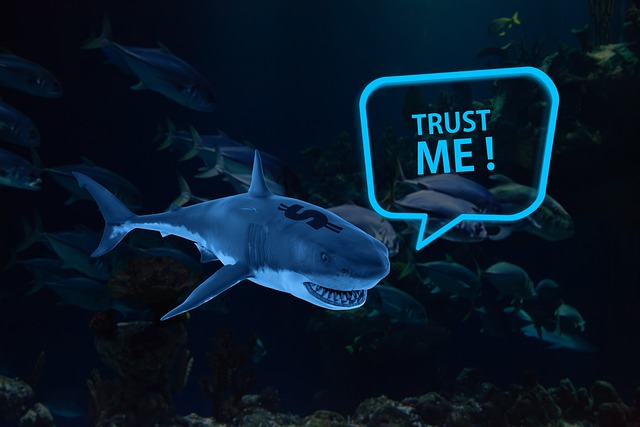

Debt relief is a lifeline for many struggling with financial obligations. One powerful tool in their arsenal? Debt Consolidation Loans with zero hidden charges. This article explores how these transparent loans can simplify repayment and offer much-needed financial freedom. We delve into the benefits of debt relief, examine the role of zero-charge loans in consolidation, and guide you through the application process, ensuring a clear understanding of what to expect. Discover how smart borrowing can pave the way for a brighter financial future with Debt Consolidation Loans.

- Understanding Debt Relief and Its Benefits

- Exploring Zero Hidden Charge Loans for Debt Consolidation

- Navigating the Process: What to Expect When Applying for Debt Consolidation Loans

Understanding Debt Relief and Its Benefits

Debt relief is a financial solution that offers individuals and families a way out of overwhelming debt. It’s about gaining control over your finances by reducing or eliminating high-interest charges and fees, making repayment more manageable. One effective strategy for debt relief is through Debt Consolidation Loans, which bundle multiple debts into a single loan with potentially lower interest rates. This approach simplifies repayment, allowing borrowers to focus on one payment instead of several.

By consolidating debts, individuals can save money on interest over time and free up cash flow for other essential expenses. It’s an opportunity to break free from the cycle of high-interest debt and rebuild financial stability. This method is particularly beneficial for those with multiple credit card debts or loans, as it streamlines the repayment process, making it easier to manage and potentially reducing the overall cost of borrowing.

Exploring Zero Hidden Charge Loans for Debt Consolidation

Many individuals seeking to manage their debt often consider Debt Consolidation Loans as a strategic solution. This approach involves bundling multiple debts into a single loan with potentially lower interest rates, making repayment more manageable. When exploring this option, it’s crucial to focus on loans with zero hidden charges. These loans offer transparency in terms and conditions, ensuring there are no surprise fees or additional costs that could complicate the consolidation process.

By opting for such loans, borrowers can gain better control over their financial situation. With all debts consolidated under one roof, making payments becomes simpler and more organized. This clarity is especially beneficial when trying to free oneself from the burden of multiple debts and high-interest rates. It allows individuals to allocate their funds more efficiently, potentially saving money in the long run.

Navigating the Process: What to Expect When Applying for Debt Consolidation Loans

When considering debt consolidation loans, understanding what lies ahead in the application process is a crucial step. It’s akin to navigating a labyrinth—you’ll need a clear strategy and a keen eye for details. The first step involves gathering essential documents like financial statements, which provide a transparent view of your current financial standing. This ensures lenders can accurately assess your ability to repay. Additionally, be prepared to offer information on the loans you wish to consolidate, including their terms and interest rates.

After submitting your application, expect a thorough review period. Lenders will scrutinize your documents, verify your income, and evaluate your credit history. Communication is key; keep an eye out for updates and be ready to provide any additional information requested. The process aims to ensure fairness and transparency, so patience is vital. Ultimately, if approved, you’ll receive a personalized loan offer tailored to consolidate your debts with zero hidden charges, marking the first step towards financial freedom.

Debt consolidation loans with zero hidden charges offer a clear and transparent path towards financial freedom. By understanding the benefits of debt relief and navigating the application process diligently, individuals can break free from the burden of excessive interest rates and fees. These loans provide an opportunity to consolidate debts, simplify repayment terms, and ultimately improve overall financial health. Remember, taking control of your finances is a significant step towards building a secure future.