Debt restructuring and debt review are contrasting approaches for managing debt. Restructuring renegotiates terms with creditors to reduce interest rates, extend repayment periods, or consolidate debts, aiming to lighten the financial burden. Debt review involves assessing financial standing, creating a realistic budget, and improving creditworthiness without altering existing debt terms. While restructuring adjusts debt terms, debt review empowers individuals to better manage their finances and enhance long-term financial stability.

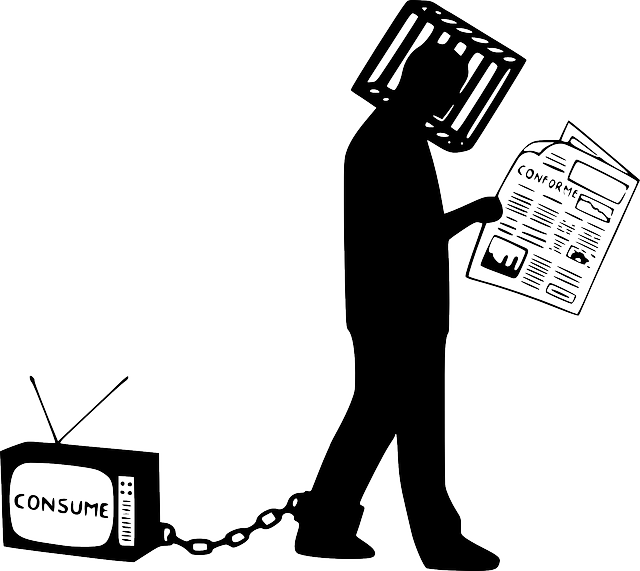

Debt can feel like an overwhelming burden, but understanding the nuances between Debt Restructuring and Debt Review is key to finding a viable solution. This article demystifies these two strategies, guiding you through their unique benefits and considerations. Discover how Debt Restructuring offers lower payments and extended terms, while Debt Review provides counseling and personalized financial strategies. Make an informed decision: choose the path that aligns with your financial goals and empowers you to regain control.

Debt Restructuring: A Comprehensive Solution

Debt restructuring is a comprehensive solution for individuals or businesses deeply entrenched in debt. It involves renegotiating the terms of one’s existing debts, often with the assistance of creditors or through formal processes like bankruptcy. The primary goal is to reduce the overall amount owed, lower interest rates, and extend repayment periods, providing a fresh financial start. This strategy is particularly beneficial when facing insurmountable debt burdens that cannot be managed under current conditions.

Unlike debt review, which primarily focuses on assessing and counseling individuals on their financial situation, debt restructuring takes concrete steps to alter the terms of indebtedness. It offers a more direct approach to resolving significant debt problems, making it a powerful tool for those seeking to regain control over their finances in the face of overwhelming debt. Understanding these distinctions is crucial when navigating the options available for managing and overcoming debt challenges.

– Definition and process overview

Debt restructuring and debt review are two distinct approaches to managing financial obligations, each with its own set of benefits and implications. Debt restructuring involves a comprehensive overhaul of an individual’s or entity’s existing debt structure. This process typically includes renegotiating terms with creditors, such as lowering interest rates, extending repayment periods, or even consolidating multiple debts into one. The goal is to create a more manageable debt load by altering the financial terms and conditions, making it easier to repay without causing significant distress.

In contrast, debt review focuses on meticulously examining an individual’s financial situation to gain insights into areas of potential improvement. It involves a detailed analysis of income, expenses, and existing debt obligations. Through this process, individuals can identify unnecessary spending patterns, find ways to cut costs, and create a realistic budget that supports their debt repayment journey. Debt review is about empowering individuals with knowledge and strategies to better manage their finances, ultimately aiming to improve creditworthiness and financial stability without necessarily altering the original terms of their debts.

When faced with overwhelming debt, understanding the nuances between debt restructuring and debt review is crucial. While both offer relief, debt restructuring involves renegotiating terms with creditors for a comprehensive solution, ideal for significant debt burdens. On the other hand, debt review provides an initial assessment and guidance, helping individuals make informed decisions about their financial situation. Choosing the right approach depends on individual circumstances, but either can be a game-changer in managing and reducing debt, ensuring a brighter financial future.