The evolution of inheritance tax in South Africa reflects societal and economic changes. Current rates are progressive, with exemptions for primary residences and personal effects, while deductions account for debts. Historical adjustments have shaped strategies like trusts and insurance to minimize tax burdens. Understanding these historical changes is crucial for effective estate planning, leveraging legal exemptions, and mitigating the impacts of inheritance tax on beneficiaries.

“Unraveling the historical changes that have shaped inheritance tax in South Africa provides a crucial context for understanding today’s regulatory landscape. This article explores the evolution of inheritance tax over time, highlighting key historical shifts. We delve into current inheritance tax rates and their intricate structure within the country, offering insights into the practical implications. Additionally, we examine exemptions and deductions, essential strategies to lighten the tax burden. The piece also guides readers through effective estate planning techniques tailored to navigate inheritance tax efficiently, while shedding light on the wider impacts on beneficiaries’ shares.”

- Evolution of Inheritance Tax in South Africa: A Historical Perspective

- Current Inheritance Tax Rates and Their Structure in SA

- Understanding Exemptions and Deductions: Lightening the Tax Burden

- Estate Planning Strategies to Efficiently Manage Inheritance Tax

- The Ripple Effects of Inheritance Tax on Beneficiaries' Share

Evolution of Inheritance Tax in South Africa: A Historical Perspective

The evolution of inheritance tax in South Africa is a fascinating journey that reflects broader societal and economic shifts over time. Historically, inheritance taxes were introduced to redistribute wealth and fund public services. In South Africa, the first significant inheritance tax legislation was enacted in the 1920s, targeting large estates to contribute to national development. However, these early laws were relatively simple and had limited impact on smaller inheritances.

Over subsequent decades, as South Africa’s economy grew and societal structures changed, so too did inheritance tax policies. The current system reflects a balance between encouraging responsible estate planning and ensuring fair taxation of substantial estates. Today, the Country offers various exemptions and deductions for Inheritance Tax, including personal exemptions and allowances that have been adjusted over time to keep pace with inflation and changing family dynamics. Estate planning strategies, such as trust structures and insurance, are commonly employed to mitigate the tax burden on beneficiaries while utilizing available legal loopholes and concessions.

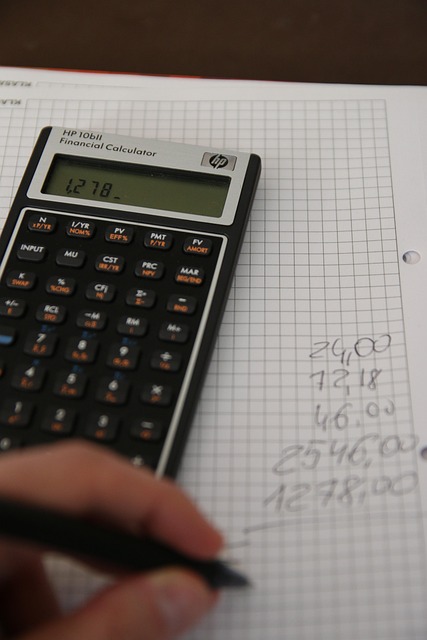

Current Inheritance Tax Rates and Their Structure in SA

In South Africa, the current Inheritance Tax (IHT) rates are structured with a focus on fairness and progressive taxation. The tax is levied on the value of an individual’s estate upon their death, with specific exemptions and deductions allowed to ease the financial burden on beneficiaries. Exemptions include certain assets like primary residences and personal effects, while deductions can offset the taxable amount by factoring in debts and other liabilities. This structured approach aims to balance the collection of taxes with the recognition of family heirlooms and essential expenses.

Historical changes in South African IHT reflect broader societal and economic shifts. Over time, tax rates have been adjusted to accommodate inflation and changing family dynamics. Estate planning strategies have also evolved, with professionals advising clients on how to minimize their IHT liability while ensuring their wishes are respected. The impacts of IHT on beneficiaries can be significant, influencing the distribution of wealth and potentially affecting intergenerational transfers. Understanding these historical changes is crucial for navigating contemporary estate planning, as it provides insights into potential future trends and allows individuals to make informed decisions regarding their assets and legacy.

Understanding Exemptions and Deductions: Lightening the Tax Burden

The current inheritance tax rates in South Africa are designed to balance fairness and fiscal responsibility. Exemptions and deductions play a significant role in lightening the tax burden, offering relief for certain assets and circumstances. These provisions have evolved over time alongside historical changes in the country’s inheritance tax landscape. Understanding these exemptions and deductions is crucial for estate planning strategies aimed at minimizing the impact of inheritance tax on beneficiaries.

Estate planners and advisors must stay informed about the latest regulations to craft effective solutions that navigate the complexities of South African inheritance tax laws. By leveraging available exemptions and deductions, individuals can ensure their wishes are carried out while minimizing the financial strain on those they leave behind. The historical changes in the tax code have shown a consistent effort to balance public revenue needs with the fairness of taxing inherited wealth, impacting both the tax rates and the criteria for exemptions and deductions.

Estate Planning Strategies to Efficiently Manage Inheritance Tax

In managing inheritance tax efficiently, estate planning strategies play a crucial role. South Africa’s current inheritance tax rates can vary significantly depending on the relationship between the deceased and the beneficiaries. Close relatives like spouses and direct descendants often enjoy exemptions and deductions that can reduce their tax burden substantially. Estate planning involves structuring assets in ways that minimize the tax impact while ensuring they pass to intended heirs.

Historical changes in South African inheritance tax have shaped these strategies. Over time, the tax has evolved to balance the need for revenue with the goal of preserving family wealth. Understanding these historical shifts helps individuals make informed decisions about their estate plans. By leveraging exemptions and deductions smartly, beneficiaries can mitigate the impacts of inheritance tax, ensuring that their inheritances are not diminished unnecessarily.

The Ripple Effects of Inheritance Tax on Beneficiaries' Share

The current inheritance tax rates in South Africa significantly influence how beneficiaries’ shares are distributed after a person’s passing. Over time, historical changes in the tax system have had ripple effects on estate planning strategies. What was once seen as a straightforward process has evolved into a complex web of considerations, with exemptions and deductions for inheritance tax playing a crucial role in mitigating financial burdens.

Understanding these historical changes is essential for comprehending the impacts of inheritance tax on beneficiaries. For instance, recent amendments have broadened exemptions for certain types of assets, allowing for more flexibility in estate planning. As such, individuals and families can strategically leverage these changes to ensure their wishes are reflected while minimizing the negative effects of inheritance tax. This includes thoughtful considerations when choosing what assets to include in an estate plan, taking advantage of available deductions, and exploring alternative methods of transferring wealth to reduce taxable amounts.

The historical changes in South African inheritance tax reflect a dynamic evolution shaped by societal shifts, economic needs, and political decisions. From its early beginnings to the current structured system, the tax has undergone significant transformations. Understanding these historical changes is key to navigating the complex landscape of inheritance tax today. By leveraging exemptions and deductions smartly and employing effective estate planning strategies, individuals can efficiently manage their tax liabilities while ensuring a fairer distribution of assets for beneficiaries in South Africa’s ever-changing economic environment.