In South Africa, Ponzi schemes pose a significant risk to investors, who should watch out for red flags like unusually high and guaranteed returns, pressure to invest quickly, lack of regulatory oversight, vague investment explanations, excessive promotional activities, and a focus on recruiting new investors. Staying informed by following official advisories from the Financial Sector Conduct Authority (FSCA), local media, and consumer protection organizations is crucial. Investors should diversify their portfolios, conduct thorough research, scrutinize promises of excessive returns, and be wary of high-pressure sales tactics to protect against Ponzi schemes, as exemplified by recent high-profile cases.

In the dynamic financial landscape of South Africa, recognizing ponzi schemes is crucial for savvy investors. This article equips you with essential insights on how to identify and avoid these deceptive investment scams. We break down the basics of ponzi schemes, highlight common red flags, and provide practical strategies for staying informed and protected. Whether you’re a seasoned investor or just starting, learn the signs to safeguard your investments in South Africa. Discover regulatory alerts, analyze offers wisely, and explore real-world examples to become a savvy, not a victim, of these schemes.

- Understanding Ponzi Schemes: The Basics for South African Investors

- Common Red Flags: What to Look Out For in Potential Investments

- Regulatory Alerts and Official Warnings: Staying Informed in SA

- Analyzing the Offer: Legitimate vs. Suspicious Opportunities

- Protecting Your Investments: Strategies for South African Savvy Investors

- Real-World Examples: Case Studies of Ponzi Schemes in South Africa

Understanding Ponzi Schemes: The Basics for South African Investors

In South Africa, as in many other countries, Ponzi schemes pose a significant risk to investors. Understanding what these schemes are and how to recognise them is crucial for protecting your financial well-being. A Ponzi scheme is an investment fraud where returns are paid to existing investors from funds contributed by new investors, rather than from any actual profit earned. This creates the illusion of successful investments, luring in more victims. The scheme ultimately collapses when it becomes unsustainable, leaving most investors with significant losses.

To recognise a Ponzi scheme in South Africa, look out for several red flags. Unusually high and guaranteed returns are a common indicator, as are pressure to invest quickly and lack of regulatory oversight or transparency. If the investment opportunity seems too good to be true, it probably is. Additionally, watch for vague or evasive answers regarding how investments are generating returns, and be wary of excessive promotional activities or a focus on recruiting new investors rather than showcasing actual performance.

Common Red Flags: What to Look Out For in Potential Investments

In South Africa, as in many countries, investors must remain vigilant to protect themselves from fraudulent schemes like Ponzi schemes. These schemes often present themselves as legitimate investment opportunities, but they are designed to defraud participants and can have devastating financial consequences. To avoid becoming a victim, it’s crucial to know the common red flags that signal a potential Ponzi scheme.

When evaluating an investment opportunity, look out for promises of unrealistic or unusually high returns with little to no risk. If an investment seems too good to be true, it probably is. Be wary of high-pressure sales tactics, lack of transparency about how investments are managed, and inconsistent or exaggerated claims about past performance. Additionally, ensure that any return on investment is generated from actual profits rather than new investor funds.

Regulatory Alerts and Official Warnings: Staying Informed in SA

In South Africa, staying informed about potential scams is crucial for investors looking to protect their hard-earned money. Regulatory bodies and government agencies play a vital role in keeping citizens updated on fraud schemes, including Ponzi schemes. How To Recognise A Ponzi Scheme In South Africa involves paying close attention to official warnings and alerts from these entities. The Financial Sector Conduct Authority (FSCA) is the primary regulator for financial services in SA, and they regularly issue advisories on scams targeting investors. Keep an eye out for their announcements and updates, which often highlight red flags and provide guidance on how to avoid becoming a victim.

Additionally, local media outlets and consumer protection organisations also contribute to investor education by disseminating information about emerging Ponzi schemes or fraudulent activities. By subscribing to reliable news sources and following trusted financial advisors, South African investors can stay ahead of the curve when it comes to identifying and avoiding these illegal investment scams.

Analyzing the Offer: Legitimate vs. Suspicious Opportunities

When evaluating investment opportunities, it’s crucial to distinguish between legitimate ventures and those that might be suspicious, especially in the case of Ponzi schemes. How To Recognise A Ponzi Scheme In South Africa involves a keen eye for certain red flags. One common indicator is an offer that promises unusually high returns with minimal risk. Be wary of investments that guarantee substantial profits or have an unreasonably low-risk profile, as these are often signs of a fraudulent scheme.

Another crucial aspect to analyze is the source and track record of the investment opportunity. Legitimate businesses typically have transparent histories, clear financial records, and verifiable success stories. If an investment seems secretive or lacks transparency, it’s a significant cause for concern. Look for independent reviews, regulatory compliance, and a diverse pool of satisfied investors as signs of legitimacy.

Protecting Your Investments: Strategies for South African Savvy Investors

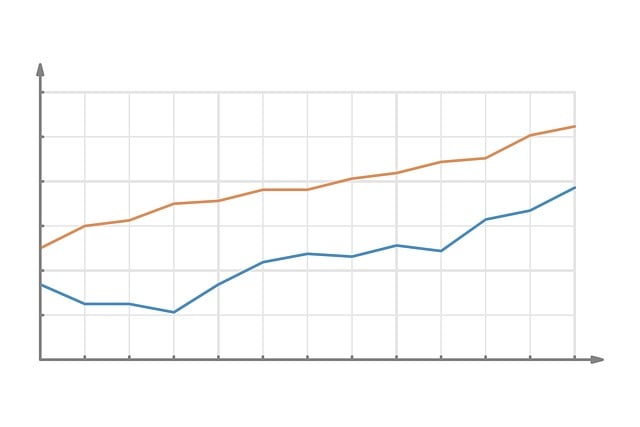

Protecting your investments is paramount for any savvy South African investor, especially in light of sophisticated fraud schemes like Ponzi schemes that have cost many their hard-earned money. Knowing how to recognise a Ponzi scheme is crucial to safeguarding your assets. One effective strategy is to diversify your portfolio across various asset classes and sectors, reducing the risk associated with any single investment. Always conduct thorough research on any investment opportunity, seeking independent verification from reliable sources.

Stay vigilant against promises of excessive returns with minimal risk. If an investment sounds too good to be true, it likely is. Be wary of high-pressure sales tactics or demands for immediate action, as these are common red flags. Regularly review your investments and stay informed about market trends and regulatory changes that could impact their performance. By adopting these strategies, South African investors can better protect themselves from the allure of Ponzi schemes and ensure the security of their financial future.

Real-World Examples: Case Studies of Ponzi Schemes in South Africa

In recent years, several high-profile cases in South Africa have shed light on the insidious nature of Ponzi schemes. One notable example is the collapse of a so-called “investment club” that promised investors lucrative returns through a network of members. However, when new investments dried up, the scheme’s creators simply used money from newer investors to pay off older ones, a classic telltale sign of a Ponzi. Similarly, a real estate venture in the early 2010s lured investors with promises of rapid property appreciation, only to disappear with millions once the market cooled down. These cases underscore the importance for South African investors of understanding how to recognise a Ponzi scheme.

By examining the patterns and red flags, investors can protect themselves from becoming victims. How To Recognise A Ponzi Scheme In South Africa involves vigilance against unrealistic promises of high returns with little or no risk. If an investment opportunity sounds too good to be true, it likely is. Other warning signs include a lack of transparency about how investments are being used and made, pressure to act quickly without sufficient time for due diligence, and inconsistent or unclear return data. Staying informed, diversifying investments, and seeking independent financial advice can significantly reduce the risk of falling prey to such fraudulent schemes.

In navigating the complex financial landscape, South African investors must remain vigilant against Ponzi schemes. By understanding the basic mechanics, recognizing common red flags, and staying informed through regulatory alerts, savvy investors can protect their hard-earned money. Analyzing investment offers critically and adopting robust protection strategies are essential steps in avoiding these fraudulent practices. Equally important is learning from real-world examples of Ponzi schemes within the country, as knowledge is a powerful tool against financial fraud. By following these insights, South African investors can make informed decisions and avoid becoming victims of such schemes, ensuring their financial security.