In South Africa, understanding how to recognize a Ponzi scheme is crucial due to their intricate and deceitful nature. These fraudulent investments promise high returns with no risk, using new investors' money to pay off old ones. Look out for excessive promises, lack of transparency, high-pressure sales tactics, and unrealistic returns. Verify investment registration and comply with local laws. If suspicious, stop investments and report concerns to authorities like the National Consumer Commission or Financial Services Board to protect yourself and others from these deceptive schemes.

In the intricate landscape of investments, a Ponzi scheme stands as a deceptive trap. This article unravels the intricate details of such schemes, offering a comprehensive guide for South Africans. We delve into the basics, from defining these fraudulent structures to identifying subtle red flags. By understanding how they operate, you can protect yourself and report suspicious activities. Learn the essential tips on recognising a Ponzi scheme in South Africa and become an informed investor.

- Understanding Ponzi Schemes: The Basics

- Identifying Red Flags: What to Look For

- Protecting Yourself: Prevention and Reporting Tips for South Africa

Understanding Ponzi Schemes: The Basics

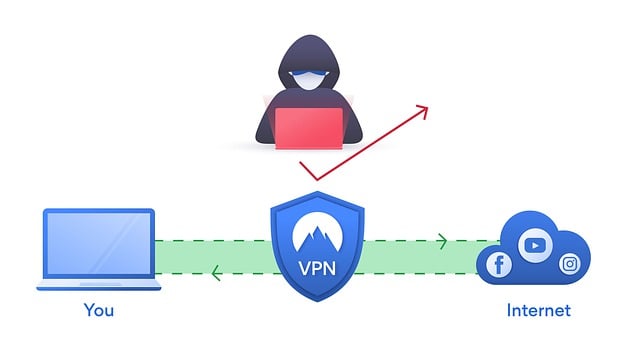

Ponzi schemes are fraudulent investment operations that promise high returns with little or no risk. They operate by using money from new investors to pay off earlier investors, creating the illusion of a successful enterprise. In South Africa, as in many other countries, these schemes can be hard to recognize due to their intricate and often seemingly legitimate structures. However, understanding the basic mechanics is key to how to recognize a Ponzi scheme.

The typical pattern involves an individual or organization promising attractive returns on investments over a short period. They attract initial investors with high-pressure sales tactics and exaggerated claims of guaranteed profits. As more people invest, the operators use this new capital to pay out older investors, maintaining the facade of a profitable venture. However, the scheme relies entirely on constant influxes of new money, making it unsustainable once investments taper off. This is why recognizing signs of distress or irregular behavior in investment opportunities is crucial for South African investors.

Identifying Red Flags: What to Look For

Recognizing a Ponzi scheme is crucial for protecting your investments in South Africa. One of the first steps to take is being vigilant and keeping an eye out for red flags. A common indicator is excessive promises of high returns with little or no risk, which often sound too good to be true. These schemes promise unrealistic rates of return, especially when compared to traditional investment options.

Another telltale sign is the absence of a clear, legitimate business model. If the scheme relies heavily on new investor funds to pay existing investors, it’s a major red flag. In South Africa, where financial regulations are in place, ensure that any investment opportunities are registered with the relevant authorities and comply with local laws. Be wary of high-pressure sales tactics or promises of exclusive access to profitable investments—these are common tactics used by Ponzi schemers to lure unsuspecting investors.

Protecting Yourself: Prevention and Reporting Tips for South Africa

Protecting yourself against Ponzi schemes in South Africa requires a keen eye and understanding of how to recognise these deceptive investment scams. The first step is to educate yourself about common signs of a Ponzi scheme, such as unrealistic returns with no legitimate investment strategy, high-pressure sales tactics, and promises of little or no risk. Remember that if an opportunity seems too good to be true, it probably is.

If you suspect an investment might be a Ponzi scheme, take action immediately. Avoid investing any more money and report your concerns to the relevant authorities, such as the National Consumer Commission or the Financial Services Board. You can also inform local police or contact consumer protection organisations for guidance. By being vigilant and proactive, you can play a crucial role in protecting yourself and others from falling victim to these fraudulent schemes.

Understanding and recognizing a Ponzi scheme in South Africa is crucial for protecting your investments. By being aware of common red flags and implementing prevention strategies, you can safeguard yourself from these deceptive schemes. If you suspect an investment opportunity might be fraudulent, report it to the relevant authorities promptly. Educating yourself and staying vigilant are key steps towards securing your financial future in a country like South Africa, where such schemes may attempt to thrive.