Before planning an inheritance, assess your financial landscape by listing all assets and liabilities. Effective inheritance planning involves determining beneficiaries, streamlining asset transfer, and minimizing tax burdens through proactive strategies. Engage a probate attorney to ensure legal compliance and protect your legacy. Regularly review and update your plan annually to account for life's changes.

Unsure where to start with inheritance planning? This comprehensive guide breaks down five essential steps to make the process stress-free. From understanding your assets and liabilities to deciding who will benefit, creating a clear plan with legal expertise, incorporating tax efficiency strategies, and regularly reviewing your plan, these steps ensure a smooth transition for you and your loved ones. Discover how to navigate inheritance planning with ease.

- Understanding Your Assets and Liabilities

- Deciding Who Will Benefit

- Creating a Clear Plan with Legal Expertise

- Incorporating Tax Efficiency Strategies

- Regularly Reviewing and Updating Your Plan

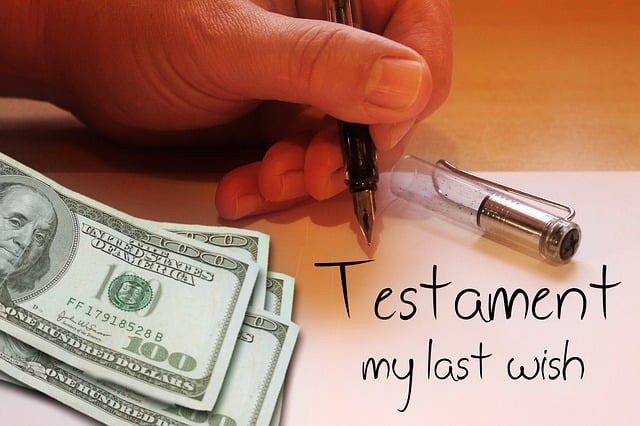

Understanding Your Assets and Liabilities

Before diving into inheritance planning, it’s crucial to have a clear understanding of your financial landscape. This involves assessing all your assets and liabilities. Start by listing everything from real estate and investments to bank accounts and personal belongings. It’s also important to consider any outstanding debts or loans, as these will impact the distribution of your estate. Understanding this financial picture is the foundation for effective inheritance planning, ensuring that your wishes are accurately reflected while minimizing potential tax burdens and legal complications.

Deciding Who Will Benefit

When it comes to inheritance planning, deciding who will benefit from your estate is a crucial step. This process involves careful consideration of family members, friends, and even charities that hold significance in your life. Remember, inheritance planning isn’t just about distributing assets; it’s an opportunity to ensure your wishes are respected and your loved ones are taken care of according to your preferences.

Take the time to evaluate your relationships and financial responsibilities. Identify who is most dependent on your support and who you wish to leave a lasting impact upon. This could include children, grandchildren, spouses, or even causes close to your heart. By making these decisions upfront, you can ensure a smooth transfer of assets, avoiding potential disputes or misunderstandings in the future.

Creating a Clear Plan with Legal Expertise

Creating a clear plan is the cornerstone of successful inheritance planning. It involves meticulously outlining your wishes regarding asset distribution, guardianship for minor dependents, and any specific instructions for your estate. This process requires a deep understanding of both personal goals and legal intricacies. Engaging the expertise of an experienced attorney specializing in probate and estate law ensures your plan is legally sound and tailored to minimize potential disputes among beneficiaries.

Legal expertise provides crucial guidance on choosing the right tools like wills, trusts, or other vehicles for asset protection and transfer. They can also help navigate complex tax implications, ensuring your plan complies with relevant laws while maximizing the value that passes to your intended heirs. This proactive approach not only simplifies the inheritance planning process but also safeguards your legacy.

Incorporating Tax Efficiency Strategies

Incorporating tax-efficient strategies is a crucial aspect of effective inheritance planning, ensuring that your assets are transferred with minimal financial burden. By understanding the various tax implications and utilizing specific legal tools, you can significantly reduce the tax liabilities associated with inheritance. One key strategy involves making use of tax exemptions and allowances available under current laws. This may include gifted assets during one’s lifetime, which can be excluded from taxable estate when passed on to heirs.

Additionally, setting up trusts is another powerful method to enhance tax efficiency. Trusts allow for controlled distribution of assets, potentially reducing the overall tax rate paid by beneficiaries. Tax-wise inheritance planning also involves considering the timing of transfers, as certain taxes may apply at different stages. Professional advice from lawyers and financial advisors can guide you in implementing these strategies, ensuring a smooth transition while maximizing the value of your legacy.

Regularly Reviewing and Updating Your Plan

Staying on top of your inheritance planning is crucial. Regularly reviewing and updating your plan ensures it reflects your current financial situation, wishes, and goals. Life is full of changes – from career shifts to life events – so your inheritance strategy should be adaptable too. A simple annual check-in can go a long way in making sure your plan is up-to-date and effective.

This proactive approach allows you to make necessary adjustments, such as adding beneficiaries or reallocating assets, ensuring that your wishes are accurately represented and that your loved ones are protected. After all, the last thing you want is for an outdated plan to cause stress or uncertainty for your family when it’s needed most.

By following these five essential steps—understanding your assets, deciding on beneficiaries, crafting a legal plan, incorporating tax strategies, and regularly reviewing your decisions—you can transform what may seem like a daunting task into a well-managed process. Effective inheritance planning ensures your wishes are respected while minimizing potential complexities for your loved ones. Embrace the opportunity to shape a legacy that reflects your values and provides peace of mind for all involved.