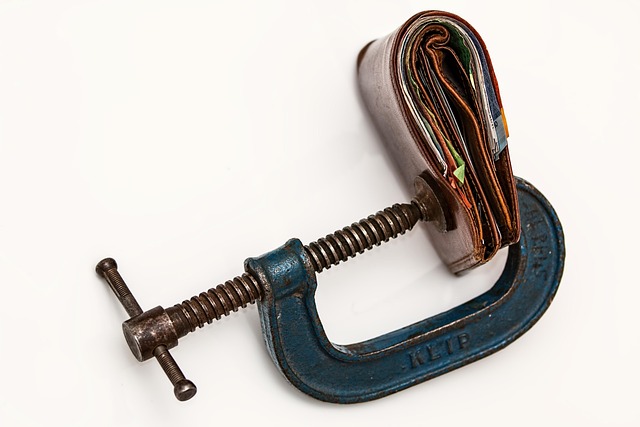

Struggling with high-interest credit card debt? Explore options like Credit Card Debt Consolidation (combining debts for lower rates), Debt Management Plans (negotiating terms with creditors) or Credit Card Debt Consolidation Loans (paying off debts outright). Factors like interest, terms and fees should guide your decision. Proactive steps are crucial for seniors seeking fast relief and improved financial health through effective debt management strategies.

Struggling with credit card debt? You’re not alone. Many individuals find themselves in a similar situation, facing high-interest bills that seem insurmountable. However, there’s hope. This article explores various debt relief options, focusing on strategies tailored to seniors and fast consolidation methods for quick results. We’ll delve into the benefits of both Credit Card Debt Consolidation Loans and Management Plans, empowering you to make informed decisions towards a debt-free future. Discover how to break free from high-interest credit card debt once and for all.

- Understanding Your Credit Card Debt Options

- Fast and Effective Debt Relief Strategies

- Choosing the Right Path: Consolidation Loans vs. Management Plans

Understanding Your Credit Card Debt Options

When facing a pile of credit card debt, it can feel overwhelming to know where to turn. However, understanding your options is the first step toward financial relief. One popular strategy for managing high interest credit card debt is credit card debt consolidation. This involves pooling multiple debts into a single loan with a lower interest rate, making repayment simpler and more affordable. For seniors or anyone looking for quick relief, consolidating credit card debt can be an attractive solution to get back on track financially.

There are various approaches to achieving credit card debt consolidation, including debt management plans that work directly with creditors to restructure payments or credit card debt consolidation loans that provide the funds to pay off your debts outright. Exploring these options and considering factors like interest rates, repayment terms, and potential fees is crucial before making a decision. Remember, achieving credit card debt relief is achievable; it requires understanding your available tools and taking proactive steps toward financial recovery.

Fast and Effective Debt Relief Strategies

Struggling with overwhelming credit card debt can be a challenging and stressful experience. However, there are several fast and effective debt relief strategies available to help seniors and individuals alike regain financial control. One popular option is Credit Card Debt Consolidation, which involves combining multiple high-interest credit card debts into one single loan with a lower interest rate. This simple consolidation can significantly reduce monthly payments and the overall cost of debt, providing much-needed relief.

For seniors looking to manage their High Interest Credit Card Debt Relief, Debt Management Plans for Credit Cards offer a structured approach. These plans involve working with a credit counseling agency to create a budget and negotiate lower interest rates or fees with creditors. By enrolling in such programs, individuals can consolidate debt quickly, often within days, and gain access to personalized support services throughout their financial journey towards Consolidate Credit Card Debt Fast. Additionally, Credit Card Debt Consolidation Loans provide a lump-sum payment to settle existing credit card balances, offering peace of mind and the opportunity to start afresh with improved financial management.

Choosing the Right Path: Consolidation Loans vs. Management Plans

When facing overwhelming credit card debt, many individuals struggle to determine the best course of action. Two prominent options that stand out are credit card debt consolidation and debt management plans. For those considering a credit card debt consolidation loan, this approach involves taking out a new loan with a lower interest rate, which then pays off existing credit cards. This strategy can be particularly beneficial for seniors dealing with high-interest credit card debt, offering them a faster path to repayment and saving on interest charges.

In contrast, debt management plans provide a more tailored solution without the need for additional loans. These plans involve working closely with a debt counseling agency that negotiates with creditors on your behalf. They often include lower monthly payments and extended terms, which can give you breathing room while still eliminating debt. While consolidation might be appealing for its speed, debt management plans can offer more flexibility and potentially better long-term financial health, especially when tailored to specific needs like those of seniors navigating high-interest rates.

Despite the challenges of credit card debt, there is hope for financial freedom. By understanding your options and taking proactive measures, such as exploring consolidation loans or enrolling in debt management plans, you can break free from high-interest debt quickly and effectively. Whether you’re a senior or anyone seeking relief, these strategies offer a fresh start and the chance to rebuild your financial future. Remember, with the right approach, managing credit card debt is achievable, allowing you to live without the constant burden.