In South Africa, individual debt restructuring offers a comprehensive solution for those burdened by high-interest debt. Expert counselors collaborate with individuals to create structured repayment plans, negotiate with creditors, and educate clients on money management. This process empowers South Africans to break free from debt, restore credit scores, and achieve financial stability through tailored strategies like budget planning and debt consolidation.

In South Africa, individual debt restructuring is a crucial strategy to overcome financial burdens. With rising costs of living and economic challenges, many individuals seek expert guidance to manage their debts effectively. This article explores the key aspects of debt restructuring for individuals in South Africa. We delve into understanding the process, highlighting the significance of professional debt counseling services, and providing management strategies for long-term relief. By employing these approaches, South Africans can navigate their financial complexities and regain control over their lives.

- Understanding Individual Debt Restructuring in South Africa

- The Role of Expert Debt Counseling Services

- Management Strategies for Effective Debt Relief

Understanding Individual Debt Restructuring in South Africa

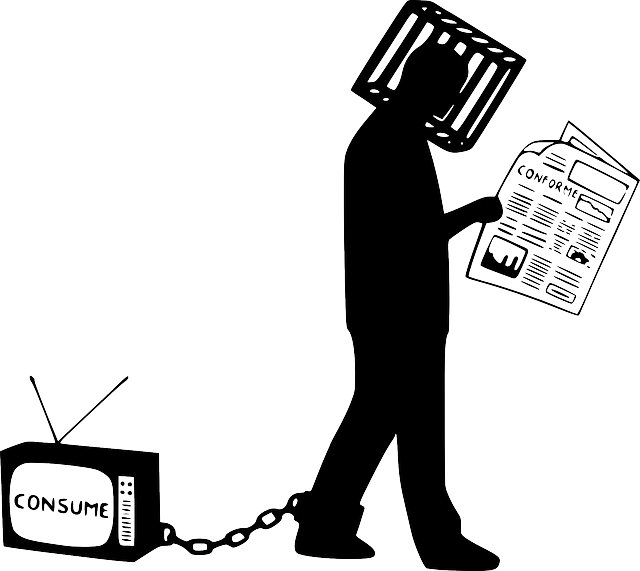

In South Africa, individual debt restructuring refers to a process where people facing overwhelming debt can reorganize and manage their financial obligations more effectively. This involves working with experts in debt counseling and management to create structured plans that allow individuals to pay off their debts over an extended period, often with reduced interest rates and more manageable monthly installments. Debt restructuring is not just about reducing payments; it’s a holistic approach aimed at empowering South Africans to regain control of their financial lives.

Expert debt counselors play a pivotal role in this process by providing guidance, education, and tailored strategies. They help individuals assess their financial situations, negotiate with creditors, and develop realistic repayment schedules. Through debt restructuring, South Africans can escape the cycle of high-interest debt, repair their credit scores, and build a more secure financial future. This option is particularly beneficial for those burdened by multiple debts or facing financial challenges due to unforeseen circumstances.

The Role of Expert Debt Counseling Services

In South Africa, where individual debt restructuring is a prevalent concern, expert debt counseling services play a pivotal role in helping citizens regain financial control. These specialized services offer comprehensive solutions for those burdened by overwhelming debts, providing guidance and support throughout the debt restructuring process. By employing tailored strategies, debt counselors assist individuals in negotiating with creditors, restructuring repayment terms, and creating sustainable financial plans to manage their debts effectively.

Expert counseling empowers clients to make informed decisions about their finances. They learn valuable money management skills, enabling them to avoid future debt traps. Moreover, these services provide a supportive environment where individuals can discuss their unique circumstances, receive personalized advice, and gain the tools needed to navigate the complexities of debt restructuring successfully.

Management Strategies for Effective Debt Relief

Debt restructuring for individuals in South Africa involves strategic management techniques to gain control and achieve relief from overwhelming debt burdens. Experts in debt counselling play a pivotal role by offering tailored solutions, helping debtors navigate their financial challenges effectively. One key strategy is budget planning, where professionals assist clients in creating realistic budgets that allocate resources efficiently while prioritizing essential expenses and debt repayments.

Additionally, debt consolidation is a popular method, combining multiple debts into one with potentially lower interest rates, simplifying repayment processes. Through negotiation and expert guidance, individuals can secure more favourable terms, making it easier to manage their finances. These management strategies not only provide immediate relief but also empower debtors with the knowledge and skills to maintain financial stability in the long term.

Debt restructuring for individuals in South Africa has become a vital strategy for gaining financial control. By leveraging expert debt counseling and management, South Africans can navigate their monetary challenges effectively. Understanding the process and employing appropriate management strategies are key to achieving long-term relief and financial stability. This comprehensive approach empowers individuals to break free from debt’s grasp and secure a brighter financial future.