Debt consolidation loans in South Africa help streamline multiple debt payments into one manageable loan, saving money on interest rates. Major banks like Absa Bank, Standard Bank, and First National Bank (FNB) offer these loans with varying terms and fees. To make an informed decision, compare details from different lenders and verify their authenticity to avoid scams. Reputable banks in South Africa provide secure, reliable loans with competitive rates and flexible terms, offering convenient online applications and management tools.

In the quest for financial freedom, debt consolidation loans offer a viable solution in South Africa. However, it’s crucial to tread carefully amidst numerous scams. This guide aims to demystify debt consolidation, equip readers with scam-spotting skills, and direct them towards secure lending options. We’ll explore which banks in South Africa provide reliable debt consolidation loans, ensuring you make informed choices without falling victim to fraudulent schemes.

- Understanding Debt Consolidation Loans in South Africa

- Identifying and Avoiding Common Debt Consolidation Scams

- Which Banks Offer Secure Debt Consolidation Loans?

Understanding Debt Consolidation Loans in South Africa

Debt consolidation loans are a popular way for South Africans to manage their debt by combining multiple payments into one manageable loan. This can simplify financial life and potentially save money on interest rates, especially if you’re paying high-interest credit card debts or personal loans. However, it’s crucial to understand how these loans work and where to get them to avoid scams.

In South Africa, several banks offer debt consolidation loans, including large institutions like Absa Bank, Standard Bank, and First National Bank (FNB). These banks provide various loan options tailored to different financial needs. When considering a debt consolidation loan, compare interest rates, repayment terms, and any associated fees from different banks. Reputable lenders will be transparent about these details, ensuring you make an informed decision that aligns with your budget.

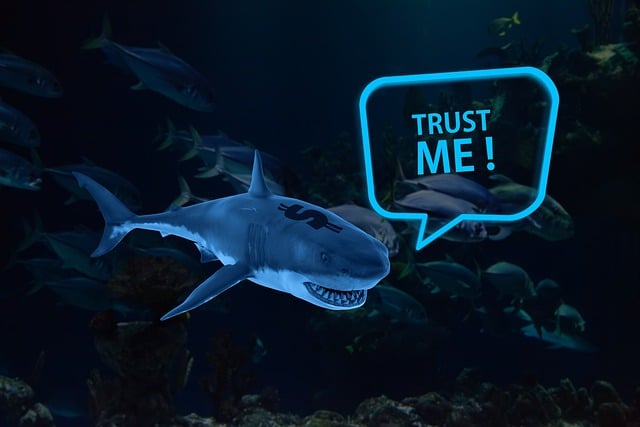

Identifying and Avoiding Common Debt Consolidation Scams

When seeking debt consolidation loans in South Africa, it’s crucial to be aware of common scams designed to exploit desperate borrowers. One frequent tactic involves con artists posing as banks or reputable financial institutions, offering seemingly attractive loan packages. They may contact you via phone, email, or even text, urgingly urging you to act quickly or face adverse consequences. These fraudsters often use high-pressure sales tactics and misleading information about low interest rates, quick approvals, and flexible repayment plans to trap unsuspecting individuals.

To avoid such scams, always verify the authenticity of any loan offer. Check if the lender is licensed and regulated by the National Credit Regulator (NCR). Confirm their contact details and compare them with those listed on official financial institutions’ websites. Ask for written confirmation of the terms, conditions, and fees associated with the loan. Additionally, never share personal or financial information over the phone or email unless you have independently verified the receiver’s identity and legitimacy. Remember, legitimate banks and credit unions in South Africa will not ask for upfront payments or threaten to impact your credit score if you don’t apply for their services immediately.

Which Banks Offer Secure Debt Consolidation Loans?

When considering debt consolidation loans in South Africa, it’s crucial to know which banks offer secure and reliable options. Several major banks in South Africa provide debt consolidation loans with competitive interest rates and flexible terms. Standard Bank, Absa, and Nedbank are among the leading institutions known for their comprehensive loan packages tailored to meet various borrower needs. These banks often have robust online platforms, making it convenient for applicants to apply and manage their loans.

Securing a loan from these reputable banks offers borrowers added peace of mind due to their established financial stability and clear terms and conditions. Additionally, these institutions may provide tools to help manage the consolidation process, ensuring that debt repayment is as streamlined as possible.