Choosing between a hospital plan and medical aid in South Africa requires understanding their distinct benefits. Which Is Better Hospital Plan Or Medical Aid? depends on individual needs, budget, and health status. Hospital plans cover inpatient treatment with simpler structures and lower costs, while medical aid schemes offer comprehensive care including outpatient services, specialist consultations, and preventive measures through a wide provider network. Opting for medical aid is more beneficial for families or those with chronic conditions needing ongoing healthcare. Cost considerations, such as premiums, co-pays, and out-of-pocket expenses, also play a crucial role in making an informed decision tailored to personal healthcare requirements.

“In South Africa, navigating healthcare options can be complex. This article provides an in-depth review and comparison of the top hospital plans and medical aid schemes available. Understanding the distinctions between these two essential healthcare coverage types is crucial for informed decisions.

We explore key factors like benefits, costs, network access, and more, to help you determine which option best suits your needs: hospital plan or medical aid. By the end, you’ll be equipped to make a confident choice regarding your healthcare security.”

- Understanding Hospital Plans and Medical Aid Schemes in South Africa

- Key Factors to Consider When Choosing Between a Hospital Plan and Medical Aid

- Popular Hospital Plans in South Africa: Features and Benefits

- Comprehensive Medical Aid Schemes: What to Expect and Why They Matter

- Cost Analysis: Comparing Premiums, Co-Payments, and Out-of-Pocket Expenses

- Access to Healthcare Providers: Network Coverage and Service Availability

Understanding Hospital Plans and Medical Aid Schemes in South Africa

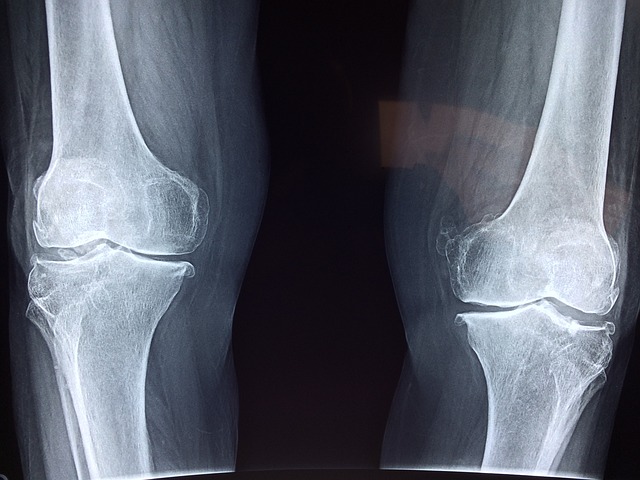

In South Africa, understanding the distinction between hospital plans and medical aid schemes is essential for making informed health care decisions. While both options offer financial protection against medical expenses, they serve different purposes and cater to distinct needs. Hospital plans primarily focus on covering inpatient treatment costs at accredited hospitals, including surgical procedures and short-term stays. On the other hand, medical aid schemes encompass a broader range of benefits, extending to outpatient care, specialist consultations, and preventive services. Choosing between a hospital plan and medical aid depends on individual circumstances, such as age, health status, and budget.

For instance, younger individuals with no pre-existing conditions might opt for a hospital plan due to its simplicity and cost-effectiveness. In contrast, families or individuals with chronic health issues may benefit more from a comprehensive medical aid scheme that provides access to a broader network of healthcare providers and specialized treatments. Comparing different plans and schemes is crucial to finding the best fit, ensuring adequate coverage while aligning with personal financial capabilities.

Key Factors to Consider When Choosing Between a Hospital Plan and Medical Aid

When deciding between a hospital plan and medical aid, several key factors should guide your choice. Firstly, consider your budget; both options have varying costs associated with them, including monthly premiums, co-pays, and out-of-pocket expenses for procedures or treatments. Understanding these financial implications is crucial in determining which option aligns better with your financial capabilities.

Secondly, assess the scope of coverage offered by each plan. Hospital plans typically cover inpatient care, while medical aid schemes often provide a broader range of services, including outpatient care, preventative treatments, and specialist consultations. Evaluating the specific benefits and limitations of each will help you decide which one better meets your healthcare needs. In terms of which is better, it ultimately depends on individual circumstances; hospital plans may be more suitable for those seeking primarily inpatient care, whereas medical aid schemes could offer greater advantages for comprehensive healthcare coverage.

Popular Hospital Plans in South Africa: Features and Benefits

In South Africa, several popular hospital plans and medical aid schemes cater to diverse needs, making it a robust market for healthcare coverage. When considering which is better between a hospital plan or medical aid, understanding their distinct features becomes crucial. Many South Africans opt for hospital plans due to their flexibility and often lower monthly contributions compared to medical aids. These plans usually cover in-patient treatment and essential services, providing peace of mind for unforeseen healthcare expenses.

Medical aids, on the other hand, offer a broader range of benefits, including routine check-ups, prescription drugs, and preventive care. They often have a network of hospitals and doctors, ensuring members access quality healthcare. The choice between the two largely depends on individual preferences and health needs. While hospital plans excel in providing comprehensive coverage for specific scenarios, medical aids tend to offer more comprehensive, all-encompassing care, making them suitable for families or those with chronic health conditions requiring regular monitoring.

Comprehensive Medical Aid Schemes: What to Expect and Why They Matter

Comprehensive medical aid schemes offer a wide range of benefits and are designed to cover most, if not all, aspects of an individual’s healthcare needs. Unlike basic plans that may only focus on specific treatments or conditions, comprehensive schemes typically include in-patient and out-patient care, hospitalisation, specialist consultations, diagnostic tests, and even certain preventive services like vaccinations. When choosing between a hospital plan and a medical aid scheme, comprehensive medical aid often stands out as the better option for several reasons.

Firstly, it provides peace of mind by ensuring access to quality healthcare when needed. Comprehensive schemes typically have networks of reputable hospitals and medical professionals, allowing members to receive treatment without worrying about additional costs or approval processes. Moreover, these plans can lead to better overall health outcomes due to early detection and preventive care measures covered under the scheme. This is particularly important in South Africa, where access to healthcare services varies widely across different regions.

Cost Analysis: Comparing Premiums, Co-Payments, and Out-of-Pocket Expenses

When comparing hospital plans and medical aid schemes in South Africa, understanding cost implications is paramount to making an informed decision about which is better for your needs. The primary factors to consider are premiums, co-payments, and out-of-pocket expenses (OPEs). Premiums refer to the regular payments you make towards your cover, with variations based on age, location, and chosen plan. Co-payments, or co-insurance, are amounts you contribute towards specific treatments or procedures after meeting a specified threshold. OPEs represent any additional costs not covered by your policy, such as deductibles or non-covered services.

An analysis of these aspects can help determine the financial burden each option imposes. Generally, medical aid schemes tend to have lower premiums but may involve higher co-payments and OPEs for specialized treatments. Hospital plans, on the other hand, often offer more predictable costs with lower upfront premiums but could result in higher out-of-pocket expenses during treatment. The ideal choice depends on individual health needs, financial capacity, and preference for self-funding versus regular payments.

Access to Healthcare Providers: Network Coverage and Service Availability

Access to healthcare providers is a critical aspect when comparing hospital plans and medical aid schemes. One key factor is network coverage—the extent to which a plan’s provider network includes hospitals, clinics, and specialists across South Africa. A comprehensive network ensures policyholders have access to a wide range of healthcare services without facing restrictions or additional costs.

When considering which is better between a hospital plan and medical aid, the availability and accessibility of service providers are essential. Medical aid schemes often have established partnerships with specific healthcare institutions, while hospital plans may offer more flexibility by partnering with a broader network. Ultimately, choosing the right option depends on individual needs, ensuring easy access to quality care when required.

When deciding between a hospital plan and medical aid in South Africa, understanding your healthcare needs and financial constraints is key. Both options offer valuable coverage, but each has its unique advantages and considerations. By evaluating factors like network coverage, cost structures, and the scope of benefits, you can make an informed choice that aligns with your budget and ensures access to quality healthcare. Ultimately, the “better” option depends on individual circumstances, making a thorough comparison essential before enrolling in any hospital plan or medical aid scheme.