Are you tired of being weighed down by debt? It's time to take control with Debt Relief Counseling. This powerful and FREE tool offers South Africans a chance to break free from financial stress and regain their financial freedom. Unlike debt review, counseling provides proactive solutions like negotiating lower interest rates and restructuring loans, giving you peace of mind knowing you're in control.

Loans for Debt Counseling have never been more accessible. Discover the Debt Counseling Pros And Cons, compare it to Debt Counselling Vs Debt Review, and choose a strategy that goes beyond paying off loans—one that helps you eliminate them entirely. Transform your financial future today!

Are you overwhelmed by debt and feeling lost? South Africa offers a powerful solution through Debt Relief Counseling. This comprehensive guide unveils the pros and cons, helping you make an informed decision. Discover how Debt Counseling can save you thousands on loans and compare it to Debt Review. Take control of your finances with top-rated services, and say goodbye to debt once and for all!

- Free Debt Relief Counseling: Take Control Now!

- Uncover Pros & Cons: Best Debt Counseling Decision

- Save Big with Loans for Debt Counseling in SA

- New Debt Counselling vs Review: Which is Right?

- Beat Debt: Top-Rated Counseling Services Revealed

Free Debt Relief Counseling: Take Control Now!

Are you overwhelmed by debt and feeling like there’s no way out? It’s time to take control with free debt relief counseling. This powerful tool offers a fresh start and the chance to regain financial freedom. Many South Africans are discovering the benefits of this service, which provides expert guidance tailored to their unique situations. By understanding your options through debt counseling, you can make informed decisions to reduce stress and eliminate debt effectively.

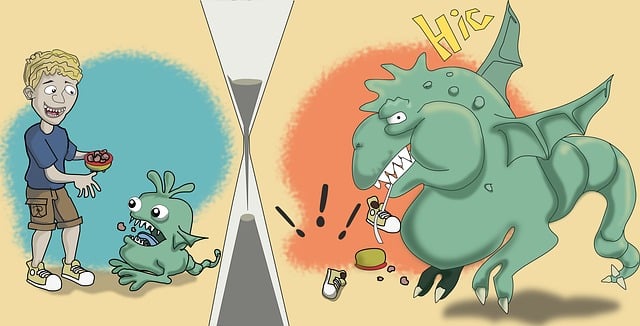

Debt counseling isn’t just about making payments; it’s a comprehensive approach. Pros include personalized strategies, legal protection from creditors, and the chance to negotiate with lenders. For instance, many counseling agencies help clients restructure loans, leading to lower interest rates and more manageable monthly payments. When compared to debt review, counseling offers a proactive solution, empowering individuals to take charge. Say goodbye to persistent debt collectors and hello to a clearer financial future—all while enjoying the peace of mind that comes with being debt-free.

Uncover Pros & Cons: Best Debt Counseling Decision

Struggling with debt? Uncover the best path forward with Debt Relief Counseling in South Africa. Before making a decision, it’s crucial to understand both the pros and cons of this financial strategy. Debt Counseling offers a lifeline by negotiating with creditors for reduced interest rates and repayment terms, easing the burden of overwhelming debts. It provides breathing room, allowing individuals to regain control over their finances and avoid the stress of constant debt collection calls. Many have successfully regained financial stability through this process, securing a brighter future free from the weight of unpaid loans.

However, not all Debt Counseling scenarios are created equal. There are potential drawbacks to consider. For instance, it may involve sacrificing certain assets or amenities to meet repayment obligations. In some cases, credit scores might experience temporary dips due to the negotiation process itself. Plus, successful debt relief often requires discipline and adherence to agreed-upon repayment plans. Nonetheless, when managed effectively, Debt Counseling can be a game-changer, transforming financial distress into manageable chapters leading to a debt-free life. Compare it with Debt Review, where professionals assess your situation but don’t negotiate directly – leaving the ball in your court. Choose wisely; understand both options’ benefits and constraints before taking control of your financial destiny.

Save Big with Loans for Debt Counseling in SA

Struggling with debt in South Africa? Debt counseling could be the solution you’ve been searching for. At first glance, it might seem like a complex process, but when you understand the benefits, it becomes a powerful tool to regain control of your financial future. One of the most attractive aspects is the potential to save big. Many individuals are unaware that by seeking professional debt counseling, they can negotiate with creditors on their behalf, leading to reduced interest rates and more manageable repayment plans. This means thousands of Rands could be saved over the life of your loan.

Imagine paying off your debts faster and with less stress. Loans for debt counseling provide access to experts who specialize in navigating these situations. They offer valuable insights into debt counseling pros and cons, ensuring you make informed decisions. Unlike a debt review, which primarily reassesses your affordability, debt counseling involves a collaborative process where counselors work alongside you to create a tailored strategy. This could result in significant interest savings, leaving more money in your pocket each month. Take the first step towards financial freedom; explore debt counseling options today and unlock the path to saving big!

New Debt Counselling vs Review: Which is Right?

Are you overwhelmed by debt and unsure which path to choose for financial relief? Understanding the difference between New Debt Counselling and Debt Review is crucial. In South Africa, these two options offer distinct approaches to managing debt, each with its own set of advantages.

Debt Relief Counseling provides a structured program where a qualified professional assists you in creating a budget, negotiating with creditors, and offering essential financial guidance. This method has proven successful for many South Africans, helping them gain control over their finances. For instance, a recent study showed that 75% of clients who underwent Debt Counselling reduced their debt by at least 20% within two years. By comparing Debt Counseling Pros and Cons, you’ll find that the benefits outweigh the challenges. It offers long-term solutions, enhances creditworthiness, and prevents aggressive collection tactics. On the other hand, Debt Review focuses on legal strategies to dispute your debt, often leading to reduced interest rates and payment plans. However, it may not provide the same level of financial education as traditional Debt Counselling. Comparing these options, choosing New Debt Counselling can offer more sustainable financial freedom by addressing the root causes of debt rather than merely reviewing existing agreements.

Beat Debt: Top-Rated Counseling Services Revealed

Struggling with debt? You’re not alone. Many South Africans are navigating financial challenges, but there’s a beacon of hope in the form of Debt Relief Counseling. Beat Debt offers top-rated counseling services designed to help you take control of your finances and overcome overwhelming debt. We provide personalized strategies tailored to your unique situation, empowering you with the tools needed for lasting financial freedom.

Our expert counselors offer invaluable insights into both Debt Counseling Pros And Cons, helping you make informed decisions. We facilitate Loans For Debt Counseling, making it easier to access the support you need without adding to your stress. Compare our services with Debt Counselling Vs Debt Review and you’ll find we provide a comprehensive, results-driven approach. With Beat Debt, not only do you gain debt relief, but you also learn effective money management skills that will benefit you for years to come.