Alternative Investments Products (AIPs) have gained popularity due to their ability to diversify financial portfolios beyond traditional stocks and bonds. This text explores various AIP types, including private equity, real estate, hedge funds, and commodity-linked securities, highlighting their unique advantages, strategies, and potential returns. By understanding these options, investors can strategically align their portfolios, access exclusive opportunities, manage risks, and potentially achieve substantial gains in today's dynamic economy. However, AIPs come with risks such as reduced liquidity, higher fees, complexity, and volatility, so thorough research and informed decision-making are crucial.

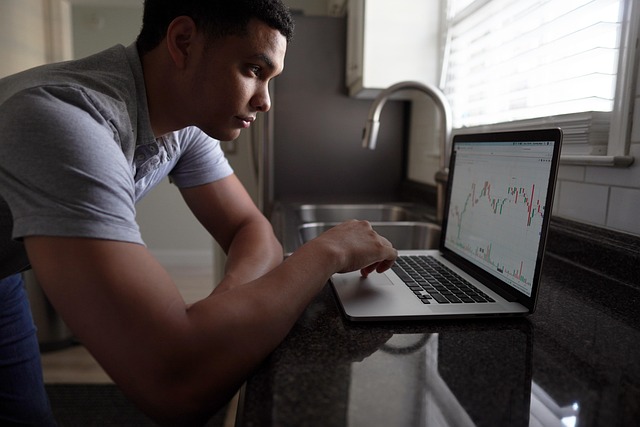

Alternative investment solutions offer a realm beyond traditional stocks and bonds, unlocking diverse opportunities for savvy investors. This article guides you through the world of alternative investments, exploring unique products like private equity, real estate, and commodities. We balance discussion on benefits and risks, providing insights into various asset classes and strategies to seamlessly integrate these innovative choices into your portfolio. Discover how to harness the power of these alternative investment products for potentially enhanced returns.

- Unlocking the World of Alternative Investments

- Understanding Unique Investment Products

- The Benefits and Risks: A Balanced Perspective

- Exploring Diverse Asset Classes

- Strategies for Integrating Alternative Investments into Your Portfolio

Unlocking the World of Alternative Investments

Alternative investments have emerged as a captivating and dynamic segment in the financial world, offering investors diverse avenues to grow their portfolios beyond traditional assets like stocks and bonds. This realm encompasses a wide array of products tailored to cater to unique investment objectives and risk profiles. From private equity and real estate to hedge funds and commodity-linked securities, each alternative investment solution presents its own set of advantages, strategies, and potential returns.

Unveiling these opportunities allows investors to navigate through complex financial landscapes and access exclusive markets. Private equity investments, for instance, enable participation in the growth and success of private companies, while real estate investments offer exposure to tangible assets with inherent value appreciation. Hedge funds, known for their flexibility and aggressive strategies, aim to deliver consistent returns regardless of market conditions. By exploring these Alternative Investments Products, savvy investors can create a well-rounded portfolio, mitigate risks, and potentially unlock substantial gains in today’s ever-evolving economic landscape.

Understanding Unique Investment Products

In the realm of alternative investments, understanding unique products is key to navigating this dynamic landscape. These go beyond traditional stocks and bonds, offering investors a diverse array of options to grow their portfolios. From private equity and real estate to commodities and hedge funds, each alternative investment product has its own risk profile, potential returns, and investment strategy. By delving into these varied alternatives, investors can tailor their portfolios to align with their financial goals and risk tolerance levels.

Unique investment products provide access to niche markets and assets that may not be available through traditional channels. For instance, real estate investments allow individuals to participate in the property market without directly owning or managing properties. Hedge funds, on the other hand, employ complex strategies to generate returns during market ups and downs. Understanding these diverse alternatives empowers investors to make informed decisions, diversifying their holdings and potentially enhancing long-term growth prospects.

The Benefits and Risks: A Balanced Perspective

Alternative investments have gained significant traction in recent years, offering investors a diverse range of products and strategies to consider. These options often provide access to unique markets, specialized assets, and potential for higher returns—all while potentially mitigating risk through diversification. From private equity and real estate to commodities and hedge funds, alternative investment products cater to various risk tolerances and financial goals. They enable investors to build a well-rounded portfolio and explore opportunities beyond traditional stocks and bonds.

However, as with any investment strategy, there are risks associated with alternatives. These investments can be less liquid than publicly traded securities, meaning they may require a longer time horizon to convert into cash without impacting their value. Additionally, they often come with higher fees, complex structures, and the potential for significant volatility or market-specific risks. Understanding these risks is crucial before diving into alternative investments. Investors should carefully review each product’s prospects, track record, and associated costs to make informed decisions that align with their long-term financial objectives.

Exploring Diverse Asset Classes

In the realm of alternative investments, exploring diverse asset classes offers investors a chance to navigate beyond traditional stocks and bonds. These alternatives, often less volatile and providing unique risk-return profiles, include real estate investment trusts (REITs), commodities, private equity, and hedge funds. Each class presents distinct advantages, catering to varied investor preferences and strategic goals.

Diversifying across these asset types allows for a more comprehensive approach to wealth management. For instance, REITs offer exposure to the real estate market, while commodities can serve as a hedge against inflation. Private equity investments provide ownership stakes in private companies, potentially yielding higher returns over time. Hedge funds, with their flexible strategies, aim to deliver consistent performance by employing various techniques such as long/short equity, arbitrage, and global macro approaches.

Strategies for Integrating Alternative Investments into Your Portfolio

When integrating alternative investments into your portfolio, a strategic approach is key. These diverse products, such as private equity, real estate, and commodities, offer unique risk profiles and potential returns distinct from traditional stocks and bonds. Diversification is a primary benefit; by allocating a portion of your assets to these alternatives, you reduce overall portfolio volatility. Start by assessing your investment goals and risk tolerance; alternative investments can be more illiquid and complex, so aligning them with your long-term objectives ensures better adaptability.

Consider your investment horizon; some alternative products, like private equity, require a longer commitment period for significant returns. Regularly review and rebalance your portfolio to maintain the desired asset allocation. Consulting a financial advisor who specializes in these areas can provide valuable insights into choosing the right alternative investments based on market trends and your personal circumstances, ensuring a well-rounded and potentially lucrative investment strategy.

Alternative investments have evolved to offer a diverse range of products, catering to various risk appetites and financial goals. By understanding these unique assets and strategically integrating them into portfolios, investors can unlock new opportunities for growth and mitigate risks. With careful consideration and a balanced perspective, alternative investment solutions provide an exciting path forward in navigating today’s dynamic market landscape.