In South Africa, recognizing Ponzi schemes is crucial to protect investors from fraudulent investment operations. Look out for unrealistic returns with minimal risk, high-pressure sales tactics, difficulty withdrawing funds, and lack of financial transparency. Verify opportunities through regulatory bodies like the Financial Services Board (FSB) and consult trusted financial advisors before investing. Staying informed and conducting thorough due diligence can help avoid these schemes.

In the intricate landscape of investments, understanding Ponzi schemes is paramount for investors in South Africa. This article delves into the intricacies of these fraudulent structures, offering a comprehensive guide on ‘How To Recognise A Ponzi Scheme In South Africa’. From unearthing the basic principles to identifying red flags and exploring regulatory frameworks, we equip readers with strategies to protect their investments. Learn to navigate this intricate web, ensuring you’re not ensnared in another sophisticated financial enigma.

- Understanding Ponzi Schemes: The Basics

- Identifying Red Flags: Common Indicators of a Ponzi Scheme

- South Africa's Regulatory Framework and Prevention Measures

- Protecting Yourself: Strategies to Avoid Falling Victim to Ponzi Schemes

Understanding Ponzi Schemes: The Basics

Ponzi schemes are a type of fraudulent investment operation that promises high returns to investors, but in reality, they rely on a constant influx of new money from subsequent investors to pay off earlier participants. Named after Charles Ponzi, who carried out one of the most infamous scams in the 1920s, these schemes often attract individuals seeking quick and easy profits. In South Africa, as in many other countries, understanding how to recognise a Ponzi scheme is crucial for protecting investors.

To identify such schemes, look out for unusual investment opportunities that promise unrealistic returns with minimal risk. If a deal sounds too good to be true, it probably is. Ponzi operators often use high-pressure sales tactics and create an air of exclusivity or urgency to lure victims. They might also make it difficult to withdraw funds or provide little to no financial transparency. How To Recognise A Ponzi Scheme In South Africa involves being alert to these red flags and seeking professional advice when in doubt.

Identifying Red Flags: Common Indicators of a Ponzi Scheme

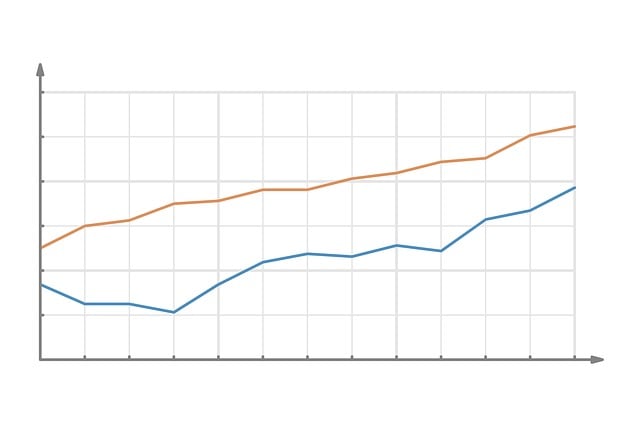

Recognizing a Ponzi scheme is crucial for protecting your investments in South Africa. While legitimate businesses may experience growing pains, a Ponzi scheme promises unrealistic returns with no real investment or product. One of the key ways to identify red flags is through unexpected or unusually high returns on investments, especially when they’re promised quickly and consistently. Be wary of schemes that focus more on enticing returns rather than providing details about how those returns are generated.

Another common indicator is the pressure to invest immediately, with threats of limited opportunities or time-sensitive offers. If a scheme requires you to keep your investment hidden from others or if it relies heavily on recruiting new investors to sustain payments to existing ones, these could be significant red flags. Always verify the legitimacy of any investment opportunity by checking with regulatory bodies and seeking advice from trusted financial advisors.

South Africa's Regulatory Framework and Prevention Measures

In South Africa, recognizing and preventing Ponzi schemes is facilitated by a robust regulatory framework designed to protect investors. The Financial Services Board (FSB) plays a pivotal role in monitoring and regulating financial services providers, including those offering investment opportunities. One of the key ways South Africans can learn to identify a Ponzi scheme is by understanding legitimate return expectations versus unrealistic promises. Schemes often allure investors with unusually high returns for minimal risk, which is a red flag.

The FSB encourages potential investors to conduct thorough due diligence before committing funds. This includes verifying the legitimacy of the investment opportunity, checking the reputation of the company or individual offering it, and understanding the underlying assets or investments. Additionally, staying informed about common Ponzi scheme tactics through official channels like the FSB’s resources can empower individuals to make wiser financial choices.

Protecting Yourself: Strategies to Avoid Falling Victim to Ponzi Schemes

Protecting yourself from falling victim to a Ponzi scheme is crucial in navigating the financial landscape, especially in South Africa where such schemes have been known to occur. The key to safeguarding your investments lies in understanding how to recognise one.

Firstly, be wary of high-return promises with little or no risk. Legitimate investment opportunities rarely offer extraordinary returns with minimal effort. Secondly, check the track record of the investment opportunity. A legitimate scheme will have a clear history of performance. If it’s too good to be true, it probably is. Additionally, verify the legitimacy of the person or entity offering the investment by checking their credentials and licence with relevant financial regulators in South Africa. Always remember: if an opportunity seems too good to be true, it’s important to dig deeper before investing your money.

Understanding how to recognise a Ponzi scheme in South Africa is crucial for protecting your investments. By being aware of common red flags and implementing strategies to avoid these scams, you can safeguard your financial future. Remember, staying informed and vigilant is key when it comes to navigating the complexities of investment opportunities. With the right knowledge, you can make smart decisions and avoid becoming a victim of fraudulent schemes.