In South Africa, understanding how to recognize a Ponzi scheme is crucial for investor protection. Key indicators include high-return promises with minimal risk, constant need for new investors, lack of transparency, and unverified claims. Historical cases like Robert Ngwe's and AGI's scams highlight the dangers. By diversifying portfolios, staying informed about market trends, and reporting suspicious activities, South Africans can navigate investments more securely. Robust reporting and enforcement mechanisms involving bodies like NCDU, FSB, SASRA, and local police help combat these fraudulent schemes, protecting investors and the financial landscape.

Understanding investment fraud, particularly Ponzi schemes, is crucial for investors in South Africa. This article delves into the unique traits and historical examples of these fraudulent schemes within the country’s financial landscape. By exploring common indicators, such as unrealistic returns and a lack of regulatory oversight, readers can learn to recognise potential red flags. We also discuss protection methods, reporting mechanisms, and the significant impact of Ponzi schemes on investors and the economy. Equip yourself with the knowledge needed to steer clear of these ‘too-good-to-be-true’ investment scams in South Africa.

- What is a Ponzi Scheme?

- Common Traits of Ponzi Schemes in South Africa

- Historical Examples of Ponzi Scams in the Country

- How to Protect Yourself from Investment Frauds

- Reporting and Enforcement Mechanisms in South Africa

- The Impact of Ponzi Schemes on Investors and the Economy

What is a Ponzi Scheme?

A Ponzi scheme is a fraudulent investment operation that promises high returns to investors, but instead of generating profits through legitimate means, it uses funds from new investors to pay off earlier investors. This creates the illusion of a successful and profitable venture, luring in more people with the prospect of quick gains. In South Africa, where financial markets are growing, recognizing these schemes is crucial for investor protection.

How To Recognise A Ponzi Scheme In South Africa involves scrutinizing investment opportunities that offer unusually high returns with little or no risk. If a scheme requires continuous influx of new investors to sustain payments to existing ones, it could be a red flag. Additionally, lack of transparency about the investment strategy, limited or no third-party verification of claims, and pressure tactics to invest quickly are common indicators.

Common Traits of Ponzi Schemes in South Africa

In South Africa, like many other countries, Ponzi schemes have become a significant concern among investors. These fraudulent investment plans share several common traits that can help South African investors learn How To Recognise A Ponzi Scheme. Typically, they promise high returns with little or no risk, attracting unsuspecting individuals looking for lucrative investment opportunities. The allure of quick and substantial profits is often the primary lure, especially in an environment where traditional investment options might seem less appealing.

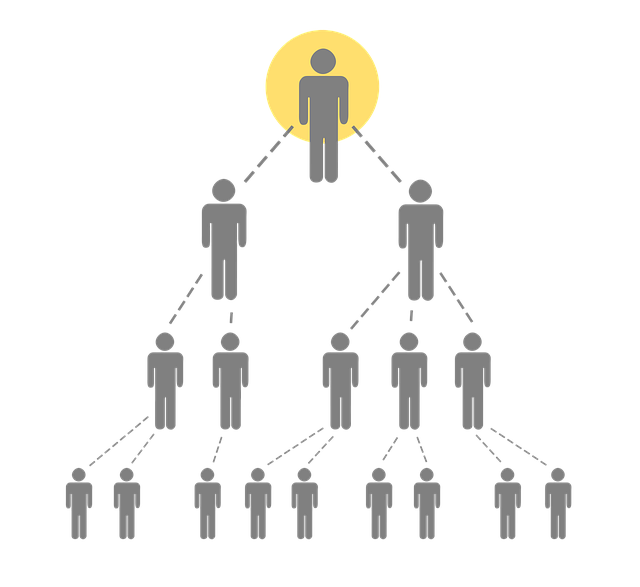

Another telltale sign is the pressure to recruit new investors to sustain the scheme. Unlike legitimate businesses that generate revenue through actual investments or sales, Ponzi schemes rely on continuous influxes of new money from participants to pay ‘returns’ to older ones. As such, schemers often encourage existing investors to bring in more people, creating a pyramid-like structure. Additionally, these schemes tend to be highly secretive, with limited transparency about how the supposed investments are made, and they frequently use high-pressure sales tactics to coerce individuals into investing.

Historical Examples of Ponzi Scams in the Country

In South Africa, the history of investment fraud is intertwined with the occurrence of Ponzi schemes. One notable example dates back to the late 1980s when a man named Robert Ngwe operated a scheme that promised investors high returns on their savings. He attracted thousands of people by offering seemingly guaranteed profits, but instead of generating legitimate returns, Ngwe used new investor money to pay existing ones. This classic Ponzi structure ultimately collapsed, leaving many South Africans with significant financial losses.

Another historical instance involves a company called African Global Investment (AGI) in the early 2010s. AGI promised investors extraordinary returns through various investment opportunities, from property to tech startups. The scheme attracted substantial funding, but it was later revealed that the funds were misappropriated for personal gain by the company’s leaders. This case underscores the importance of understanding how to recognise a Ponzi scheme in South Africa, as these historical examples highlight the potential dangers and sophisticated techniques employed by fraudsters.

How to Protect Yourself from Investment Frauds

Protecting yourself from investment fraud, particularly Ponzi schemes, requires vigilance and a keen eye for detail. In South Africa, where financial crimes like these are on the rise, it’s crucial to educate yourself before investing your hard-earned money. Start by understanding that a Ponzi scheme is a fraudulent investment operation promising high returns with little or no risk. The ‘return’ comes from new investors’ money rather than any actual profit gained through legitimate means.

To avoid becoming a victim, learn how to recognise the signs. Be wary of investments that offer unusually high and guaranteed returns. If an opportunity seems too good to be true, it probably is! Diversify your investments and never put all your funds into one scheme or individual investment. Regularly review your investments and stay informed about market trends. Keep yourself updated on regulatory changes and fraud alerts issued by the Financial Services Board (FSB) in South Africa, which can provide valuable insights into potential scams.

Reporting and Enforcement Mechanisms in South Africa

In South Africa, reporting and enforcement mechanisms play a crucial role in combating investment fraud, particularly Ponzi schemes. The National Crime Investigation Unit (NCDU) is tasked with investigating financial crimes, including fraud. Investors are encouraged to report suspicious activities by familiarising themselves with the signs of a Ponzi scheme. How To Recognise A Ponzi Scheme In South Africa involves understanding unusual promises of high returns with little or no risk, as well as pressure tactics used to encourage investments.

The Financial Services Board (FSB) acts as the regulatory body, overseeing financial services providers and enforcing compliance with laws. They offer guidance on how to identify fraudulent schemes, highlighting the importance of due diligence when considering any investment opportunity. Additionally, local police departments and the South African Securities Regulation Authority (SASRA) work collaboratively to enforce regulations and protect investors from fraudsters, ensuring that appropriate measures are in place to detect and penalise those involved in these illicit activities.

The Impact of Ponzi Schemes on Investors and the Economy

Ponzi schemes, while alluring with promises of high returns, have devastating consequences for investors in South Africa. When an individual or entity operates a Ponzi scheme, they attract new investors by paying out seemingly substantial returns to existing ones—not from actual investment profits but from funds contributed by newer investors. This fraudulent practice creates the illusion of a successful investment opportunity, luring more people in. However, as time goes on, it becomes unsustainable, leading to widespread losses for innocent investors who are left with empty promises and financial ruin.

The impact extends beyond individual investors; it can destabilise the economy. Ponzi schemes disrupt market stability by encouraging speculative behaviour and misleading people into making uninformed investment decisions. In South Africa, where economic challenges are already prevalent, these fraudulent activities can exacerbate inequality and further burden the financial system. Understanding how to recognise a Ponzi scheme is crucial for both investors and regulatory bodies to prevent such schemes from thriving and safeguarding the country’s financial landscape. Knowing the signs and being vigilant can help protect individuals and foster a healthier investment environment in South Africa.

Understanding investment fraud, particularly Ponzi schemes, is pivotal for protecting oneself in the South African financial landscape. By being aware of common traits like unrealistic returns and a lack of transparency, individuals can avoid becoming victims. Historical examples underscore the need for vigilance, while robust reporting mechanisms ensure that perpetrators face justice. Protecting investors and the economy from these schemes is a collective responsibility, with education on how to recognise a Ponzi scheme in South Africa being a key strategy for prevention.