Ponzi schemes, a global fraud prevalent in South Africa, pose significant risks to investors with promises of high returns and minimal effort. These unsustainable models rely on new investor funds, leading to market disruption, investment patterns skewing, and eroded confidence. Recent surges in such schemes highlight the need for regulatory oversight by bodies like FSPA, public awareness programs, and collaboration among stakeholders to protect financial stability and prevent substantial losses.

“Unveiling the Insidious Nature of Ponzi Schemes in South Africa’s Financial Landscape: A Comprehensive Analysis. This article delves into the rising concern of Ponzi schemes, their profound impact on the country’s financial system and investor confidence, and historical perspectives that shed light on this deceptive practice. From case studies of notorious scams to exploring regulatory measures, education, and awareness campaigns, we unravel the complexities and offer insights into mitigating risks in South Africa’s market.”

- Understanding Ponzi Schemes: A Definition and Historical Perspective

- The Prevalence of Ponzi Schemes in South Africa: A Growing Concern

- How These Schemes Undermine the Financial System and Investor Confidence

- Case Studies: Notable Ponzi Schemes That Rocked the South African Market

- Mitigating Risks: Regulatory Measures, Education, and Investor Awareness

Understanding Ponzi Schemes: A Definition and Historical Perspective

Ponzi schemes are a form of fraud where investors are promised high returns with little or no risk. The returns are not generated from any actual investment or business activity but instead paid to previous investors as the scheme grows. This unsustainable model relies on constant influxes of new money from subsequent investors to maintain the illusion of success and pay out existing participants. Historically, Ponzi schemes have appeared throughout time, with one of the most famous examples being Charles Ponzi’s scheme in the 1920s, which defrauded thousands of people worldwide.

In South Africa, Ponzi schemes have emerged as a significant concern within its financial system. These scams often target vulnerable investors, offering attractive returns on investments with minimal effort or knowledge required. As the scheme expands, it can attract substantial funding, creating an illusion of legitimacy and success. However, like their historical counterparts, these schemes ultimately collapse when new investments dry up, leaving many investors with significant losses. Understanding the dynamics of Ponzi schemes is crucial in combating their prevalence in South Africa and safeguarding the country’s financial stability.

The Prevalence of Ponzi Schemes in South Africa: A Growing Concern

In recent years, Ponzi Schemes in South Africa have emerged as a significant and growing concern within the country’s financial landscape. These fraudulent investment schemes, which promise high returns with minimal risk, have attracted a considerable number of unsuspecting investors, particularly in urban areas. The allure of quick and easy wealth has led to a surge in their popularity, posing a substantial threat to South Africa’s financial stability and investor confidence.

The prevalence of Ponzi Schemes in South Africa is not only limiting but also detrimental to the growth and development of the nation’s economy. As these schemes unfold, they leave a trail of devastated investors and a shattered financial system. With the promise of substantial returns, many individuals have fallen victim, only to discover that their investments were illusory. This has resulted in a growing awareness among the public and regulatory bodies alike, who are now actively working to combat this ever-evolving fraud.

How These Schemes Undermine the Financial System and Investor Confidence

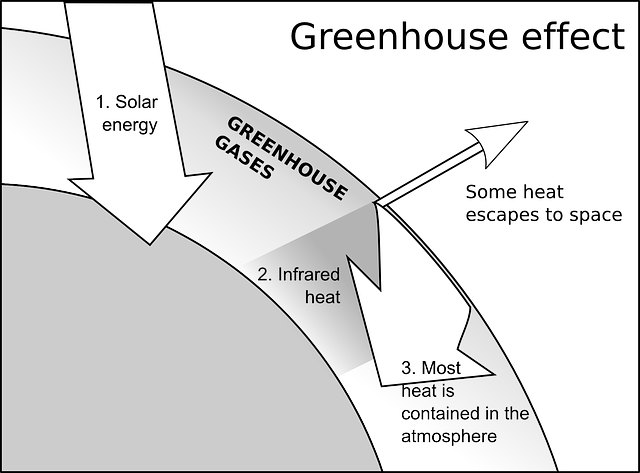

Ponzi schemes, prevalent in South Africa’s financial landscape, pose a significant threat to the country’s economic stability and investor confidence. These fraudulent investments promise high returns with little risk, attracting unsuspecting individuals seeking financial gains. However, the very nature of Ponzi schemes ensures that new investors’ money is used to pay existing ones, creating a false sense of profitability. As more people invest, the scheme expands, luring even broader audiences until it eventually collapses, leaving numerous victims with substantial losses.

The impact on the financial system is twofold. Firstly, it disrupts the market’s equilibrium, as ill-gotten funds can distort investment patterns and skew performance metrics. Secondly, the loss of investor confidence erodes the foundation of a healthy economic environment. When Ponzi schemes gain traction, legitimate businesses and investments may struggle to attract funding, hindering growth and development across various sectors in South Africa.

Case Studies: Notable Ponzi Schemes That Rocked the South African Market

In recent years, South Africa has witnessed several high-profile cases of Ponzi schemes that have shaken the financial stability of the nation. These fraudulent investments have attracted significant attention due to their widespread impact on investors and the potential long-term effects on the economy. One notable example is the scheme orchestrated by a prominent local businessman who promised astronomical returns on crypto-related investments. The allure of quick profits enticed many South Africans, leading to substantial losses when the truth behind the scheme was revealed. This case study highlights the sophistication and reach of modern Ponzi operations in South Africa.

Another significant incident involved a life insurance company that offered seemingly incredible savings plans. Investors were promised guaranteed high returns with minimal risk, drawing in a large number of individuals seeking financial security. However, as regulatory bodies investigated, it became apparent that the company was using new investors’ funds to pay existing participants, a classic characteristic of Ponzi schemes. These cases demonstrate the importance of investor vigilance and regulatory oversight in combating such fraudulent activities within South Africa’s financial system.

Mitigating Risks: Regulatory Measures, Education, and Investor Awareness

To mitigate risks posed by Ponzi schemes in South Africa, a multi-faceted approach is crucial. Regulatory measures play a pivotal role in identifying and stopping fraudulent activities through stringent oversight and strict enforcement of existing laws. The South African Financial Sector Regulation Authority (FSPA) has implemented guidelines to protect investors, ensuring that financial services providers adhere to ethical standards and transparent practices.

Education and investor awareness are equally vital. Financial literacy programs can empower individuals to recognize signs of a Ponzi scheme, such as unrealistic returns, lack of transparency, and high-pressure sales tactics. By promoting understanding of investment risks and safe investing habits, investors become more cautious and less susceptible to fraudulent schemes. Collaboration between regulatory bodies, financial institutions, and community organizations can help foster a culture of informed investment decisions among South Africans.

Ponzi Schemes in South Africa pose a significant threat to the country’s financial stability and investor trust. As illustrated throughout this article, these schemes have historically targeted vulnerable investors, leading to substantial losses and market disruptions. By implementing robust regulatory measures, enhancing financial literacy, and promoting transparent practices, South Africa can better protect its citizens from such fraudulent activities. Increased public awareness about Ponzi Schemes is crucial to fostering a resilient investment culture and safeguarding the integrity of the nation’s financial system.